Page 194 - EXIM-BANK-AR20

P. 194

192 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

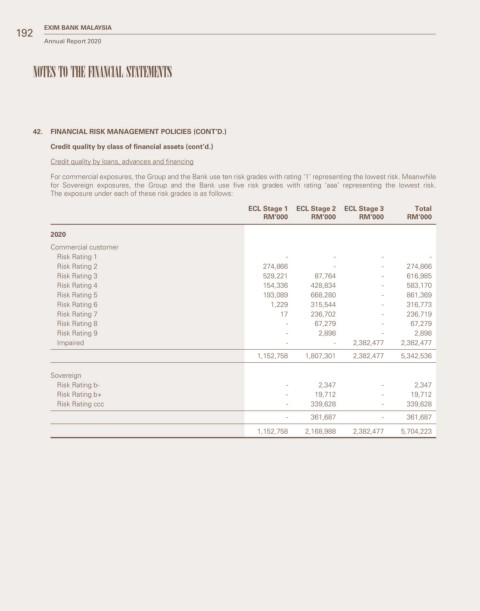

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Credit quality by class of financial assets (cont’d.)

Credit quality by loans, advances and financing

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk.

The exposure under each of these risk grades is as follows:

ECL Stage 1 ECL Stage 2 ECL Stage 3 Total

RM’000 RM’000 RM’000 RM’000

2020

Commercial customer

Risk Rating 1 - - - -

Risk Rating 2 274,866 - - 274,866

Risk Rating 3 529,221 87,764 - 616,985

Risk Rating 4 154,336 428,834 - 583,170

Risk Rating 5 193,089 668,280 - 861,369

Risk Rating 6 1,229 315,544 - 316,773

Risk Rating 7 17 236,702 - 236,719

Risk Rating 8 - 67,279 - 67,279

Risk Rating 9 - 2,898 - 2,898

Impaired - - 2,382,477 2,382,477

1,152,758 1,807,301 2,382,477 5,342,536

Sovereign

Risk Rating b- - 2,347 - 2,347

Risk Rating b+ - 19,712 - 19,712

Risk Rating ccc - 339,628 - 339,628

- 361,687 - 361,687

1,152,758 2,168,988 2,382,477 5,704,223