Page 190 - EXIM-BANK-AR20

P. 190

188 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

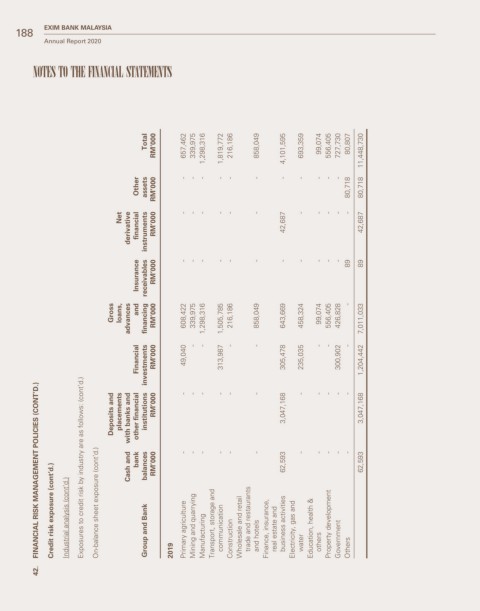

Total RM’000 657,462 339,975 1,298,316 1,819,772 216,186 858,049 4,101,595 693,359 99,074 556,405 727,730 80,807 11,448,730

Other assets RM’000 - - - - - - - - - - - 80,718 80,718

derivative financial instruments RM’000 42,687

Net - - - - - - 42,687 - - - - -

- - - - - - - - - - - 89 89

Insurance receivables RM’000

Gross loans, advances and financing RM’000 608,422 339,975 1,298,316 1,505,785 216,186 858,049 643,669 458,324 99,074 556,405 426,828 - 7,011,033

Financial investments RM’000 49,040 313,987 305,478 235,035 300,902 1,204,442

- - - - - - -

FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Deposits and placements with banks and other financial bank institutions RM’000 - - - - - - - - - - - - 3,047,168 62,593 - - - - - - - - - - 3,047,168 62,593

Credit risk exposure (cont’d.) Industrial analysis (cont’d.) Exposures to credit risk by industry are as follows: (cont’d.) On-balance sheet exposure (cont’d.) Cash and balances Group and Bank RM’000 Primary agriculture Mining and quarrying Manufacturing Transport, storage and communication Construction Wholesale and retail trade and restaurants and hotels Finance, insurance, real estate and business activities Electricity, gas and E

42. 2019 water others Others