Page 195 - EXIM-BANK-AR20

P. 195

Section 06 Financial Statements

193

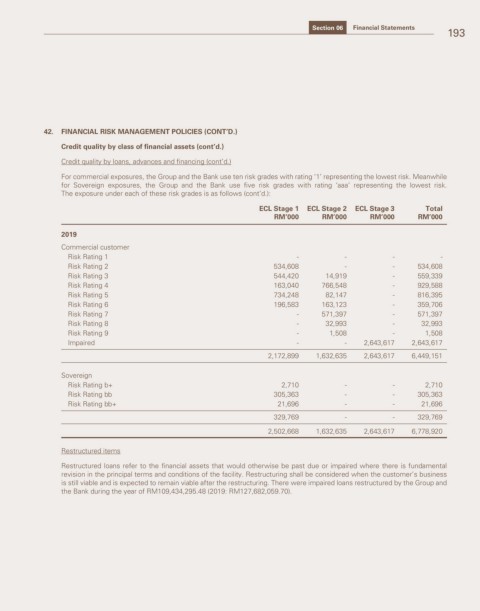

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Credit quality by class of financial assets (cont’d.)

Credit quality by loans, advances and financing (cont’d.)

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk.

The exposure under each of these risk grades is as follows (cont’d.):

ECL Stage 1 ECL Stage 2 ECL Stage 3 Total

RM’000 RM’000 RM’000 RM’000

2019

Commercial customer

Risk Rating 1 - - - -

Risk Rating 2 534,608 - - 534,608

Risk Rating 3 544,420 14,919 - 559,339

Risk Rating 4 163,040 766,548 - 929,588

Risk Rating 5 734,248 82,147 - 816,395

Risk Rating 6 196,583 163,123 - 359,706

Risk Rating 7 - 571,397 - 571,397

Risk Rating 8 - 32,993 - 32,993

Risk Rating 9 - 1,508 - 1,508

Impaired - - 2,643,617 2,643,617

2,172,899 1,632,635 2,643,617 6,449,151

Sovereign

Risk Rating b+ 2,710 - - 2,710

Risk Rating bb 305,363 - - 305,363

Risk Rating bb+ 21,696 - - 21,696

329,769 - - 329,769

2,502,668 1,632,635 2,643,617 6,778,920

Restructured items

Restructured loans refer to the financial assets that would otherwise be past due or impaired where there is fundamental

revision in the principal terms and conditions of the facility. Restructuring shall be considered when the customer’s business

is still viable and is expected to remain viable after the restructuring. There were impaired loans restructured by the Group and

the Bank during the year of RM109,434,295.48 (2019: RM127,682,059.70).