Page 200 - EXIM-BANK-AR20

P. 200

198 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

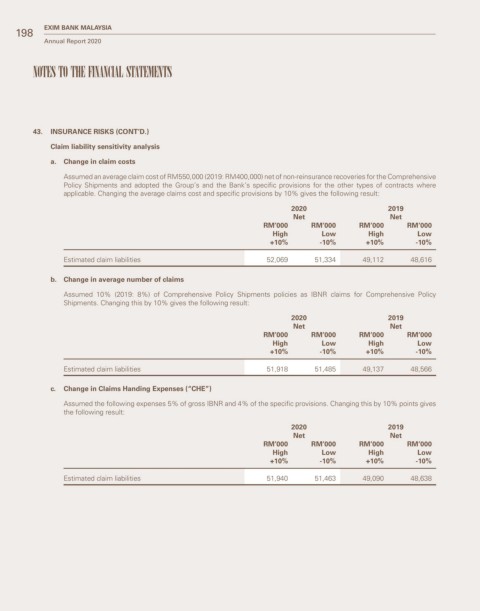

43. INSURANCE RISKS (CONT’D.)

Claim liability sensitivity analysis

a. Change in claim costs

Assumed an average claim cost of RM550,000 (2019: RM400,000) net of non-reinsurance recoveries for the Comprehensive

Policy Shipments and adopted the Group’s and the Bank’s specific provisions for the other types of contracts where

applicable. Changing the average claims cost and specific provisions by 10% gives the following result:

2020 2019

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated claim liabilities 52,069 51,334 49,112 48,616

b. Change in average number of claims

Assumed 10% (2019: 8%) of Comprehensive Policy Shipments policies as IBNR claims for Comprehensive Policy

Shipments. Changing this by 10% gives the following result:

2020 2019

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated claim liabilities 51,918 51,485 49,137 48,566

c. Change in Claims Handing Expenses (“CHE”)

Assumed the following expenses 5% of gross IBNR and 4% of the specific provisions. Changing this by 10% points gives

the following result:

2020 2019

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated claim liabilities 51,940 51,463 49,090 48,638