Page 185 - EXIM-BANK-AR20

P. 185

Section 06 Financial Statements

183

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Credit risk exposure (cont’d.)

Collateral and credit enhancement (cont’d.)

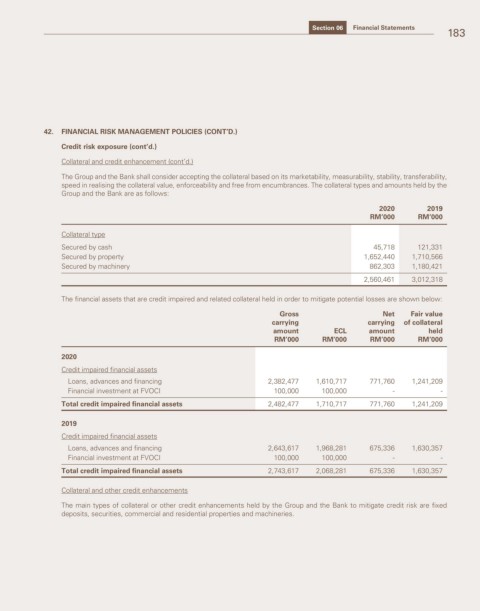

The Group and the Bank shall consider accepting the collateral based on its marketability, measurability, stability, transferability,

speed in realising the collateral value, enforceability and free from encumbrances. The collateral types and amounts held by the

Group and the Bank are as follows:

2020 2019

RM’000 RM’000

Collateral type

Secured by cash 45,718 121,331

Secured by property 1,652,440 1,710,566

Secured by machinery 862,303 1,180,421

2,560,461 3,012,318

The financial assets that are credit impaired and related collateral held in order to mitigate potential losses are shown below:

Gross Net Fair value

carrying carrying of collateral

amount ECL amount held

RM’000 RM’000 RM’000 RM’000

2020

Credit impaired financial assets

Loans, advances and financing 2,382,477 1,610,717 771,760 1,241,209

Financial investment at FVOCI 100,000 100,000 - -

Total credit impaired financial assets 2,482,477 1,710,717 771,760 1,241,209

2019

Credit impaired financial assets

Loans, advances and financing 2,643,617 1,968,281 675,336 1,630,357

Financial investment at FVOCI 100,000 100,000 - -

Total credit impaired financial assets 2,743,617 2,068,281 675,336 1,630,357

Collateral and other credit enhancements

The main types of collateral or other credit enhancements held by the Group and the Bank to mitigate credit risk are fixed

deposits, securities, commercial and residential properties and machineries.