Page 184 - EXIM-BANK-AR20

P. 184

182 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

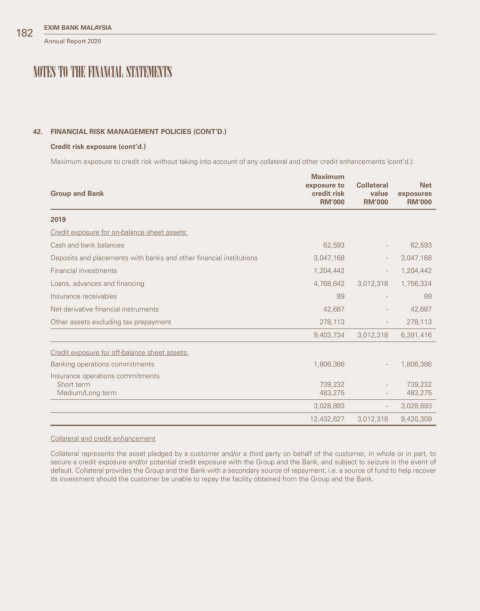

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Credit risk exposure (cont’d.)

Maximum exposure to credit risk without taking into account of any collateral and other credit enhancements (cont’d.):

Maximum

exposure to Collateral Net

Group and Bank credit risk value exposures

RM’000 RM’000 RM’000

2019

Credit exposure for on-balance sheet assets:

Cash and bank balances 62,593 - 62,593

Deposits and placements with banks and other financial institutions 3,047,168 - 3,047,168

Financial investments 1,204,442 - 1,204,442

Loans, advances and financing 4,768,642 3,012,318 1,756,324

Insurance receivables 89 - 89

Net derivative financial instruments 42,687 - 42,687

Other assets excluding tax prepayment 278,113 - 278,113

9,403,734 3,012,318 6,391,416

Credit exposure for off-balance sheet assets:

Banking operations commitments 1,806,386 - 1,806,386

Insurance operations commitments

Short term 739,232 - 739,232

Medium/Long term 483,275 - 483,275

3,028,893 - 3,028,893

12,432,627 3,012,318 9,420,309

Collateral and credit enhancement

Collateral represents the asset pledged by a customer and/or a third party on behalf of the customer, in whole or in part, to

secure a credit exposure and/or potential credit exposure with the Group and the Bank, and subject to seizure in the event of

default. Collateral provides the Group and the Bank with a secondary source of repayment, i.e. a source of fund to help recover

its investment should the customer be unable to repay the facility obtained from the Group and the Bank.