Page 9 - EXIM-BANK-AR20

P. 9

Section 01 Bridging Opportunities

7

OVERVIEW OF

OUR BUSINESS OPERATIONS

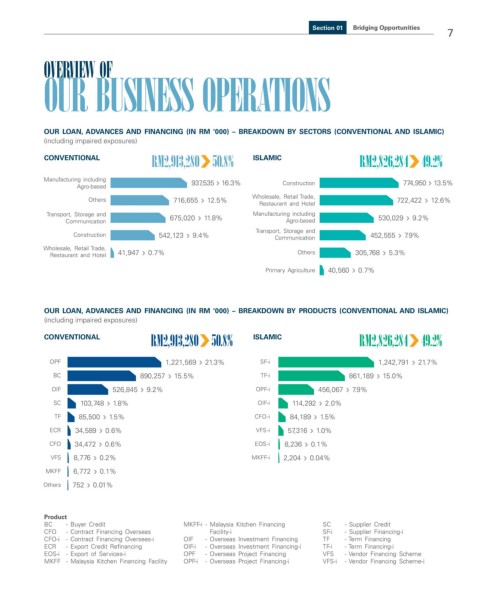

OUR LOAN, ADVANCES AND FINANCING (IN RM ‘000) – BREAKDOWN BY SECTORS (CONVENTIONAL AND ISLAMIC)

(including impaired exposures)

RM2,913,280 50.8% RM2,826,284 49.2%

CONVENTIONAL ISLAMIC

Manufacturing including 937,535 16.3% 774,950 13.5%

Agro-based Construction

Others 716,655 12.5% Wholesale, Retail Trade, 722,422 12.6%

Restaurant and Hotel

Transport, Storage and 675,020 11.8% Manufacturing including 530,029 9.2%

Communication Agro-based

Transport, Storage and

Construction 542,123 9.4% Communication 452,555 7.9%

Wholesale, Retail Trade,

Restaurant and Hotel 41,947 0.7% Others 305,768 5.3%

Primary Agriculture 40,560 0.7%

OUR LOAN, ADVANCES AND FINANCING (IN RM ‘000) – BREAKDOWN BY PRODUCTS (CONVENTIONAL AND ISLAMIC)

(including impaired exposures)

RM2,913,280 50.8% RM2,826,284 49.2%

CONVENTIONAL ISLAMIC

OPF 1,221,569 21.3% SF-i 1,242,791 21.7%

BC 890,257 15.5% TF-i 861,189 15.0%

OIF 526,845 9.2% OPF-i 456,067 7.9%

SC 103,748 1.8% OIF-i 114,292 2.0%

TF 85,500 1.5% CFO-i 84,189 1.5%

ECR 34,589 0.6% VFS-i 57,316 1.0%

CFO 34,472 0.6% EOS-i 8,236 0.1%

VFS 8,776 0.2% MKFF-i 2,204 0.04%

MKFF 6,772 0.1%

Others 752 0.01%

Product

BC - Buyer Credit MKFF-i - Malaysia Kitchen Financing SC - Supplier Credit

CFO - Contract Financing Overseas Facility-i SF-i - Supplier Financing-i

CFO-i - Contract Financing Overseas-i OIF - Overseas Investment Financing TF - Term Financing

ECR - Export Credit Refinancing OIF-i - Overseas Investment Financing-i TF-i - Term Financing-i

EOS-i - Export of Services-i OPF - Overseas Project Financing VFS - Vendor Financing Scheme

MKFF - Malaysia Kitchen Financing Facility OPF-i - Overseas Project Financing-i VFS-i - Vendor Financing Scheme-i