Page 103 - Exim iar24_Ebook

P. 103

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 101

DIRECTORS’ REPORT

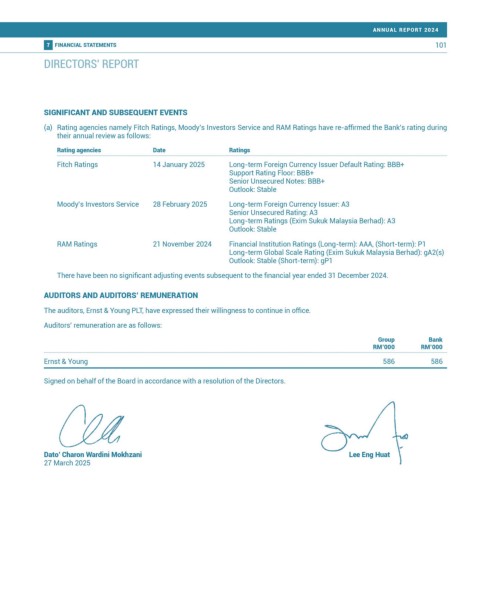

SIGNIFICANT AND SUBSEQUENT EVENTS

(a) Rating agencies namely Fitch Ratings, Moody’s Investors Service and RAM Ratings have re-affirmed the Bank’s rating during

their annual review as follows:

Rating agencies Date Ratings

Fitch Ratings 14 January 2025 Long-term Foreign Currency Issuer Default Rating: BBB+

Support Rating Floor: BBB+

Senior Unsecured Notes: BBB+

Outlook: Stable

Moody’s Investors Service 28 February 2025 Long-term Foreign Currency Issuer: A3

Senior Unsecured Rating: A3

Long-term Ratings (Exim Sukuk Malaysia Berhad): A3

Outlook: Stable

RAM Ratings 21 November 2024 Financial Institution Ratings (Long-term): AAA, (Short-term): P1

Long-term Global Scale Rating (Exim Sukuk Malaysia Berhad): gA2(s)

Outlook: Stable (Short-term): gP1

There have been no significant adjusting events subsequent to the financial year ended 31 December 2024.

AUDITORS AND AUDITORS’ REMUNERATION

The auditors, Ernst & Young PLT, have expressed their willingness to continue in office.

Auditors’ remuneration are as follows:

Group Bank

RM’000 RM’000

Ernst & Young 586 586

Signed on behalf of the Board in accordance with a resolution of the Directors.

Dato’ Charon Wardini Mokhzani Lee Eng Huat

27 March 2025