Page 106 - Exim iar24_Ebook

P. 106

EXIM BANK MALAYSIA

104

SHARIAH COMMITTEE’S REPORT

ISLAMIC FIRST POLICY

The Shariah Committee acknowledges and fully supports the Bank’s commitment to advancing Islamic finance business through

its Islamic First Policy (IFP), which is anchored on three core principles:

a. Prioritising Islamic Finance

Islamic financial solutions are prioritized over conventional products, except in justified circumstances where Shariah-compliant

alternatives are unavailable or unsuitable.

b. Ensuring Shariah Compliance

All Islamic financing activities are aligned with Shariah principles, ensuring ethical, transparent, and responsible financial

practices. The Shariah Committee also commends the Bank’s dedication to upholding Shariah compliance, as demonstrated

through its proactive internal review processes. The recent identification of a SNC event highlights the effectiveness of the IFP

initiative as a key driver in fostering robust Shariah governance and maintaining a strong commitment to Shariah integrity.

c. Embedding a Shariah Compliance Culture

The Bank actively fosters a Shariah-compliant culture across all operations, promoting continuous awareness, adherence, and

integrity in Islamic finance.

Through these key principles, the Shariah Committee recognises the significant outcomes driven by the implementation of

the Islamic First Policy. It has contributed to the growth of Islamic assets, expanded the Bank’s Islamic financing portfolio,

and reinforced Shariah compliance across all facets of banking operations.

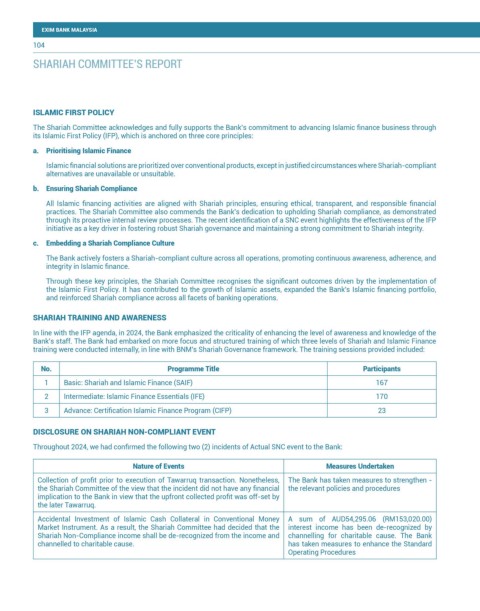

SHARIAH TRAINING AND AWARENESS

In line with the IFP agenda, in 2024, the Bank emphasized the criticality of enhancing the level of awareness and knowledge of the

Bank’s staff. The Bank had embarked on more focus and structured training of which three levels of Shariah and Islamic Finance

training were conducted internally, in line with BNM’s Shariah Governance framework. The training sessions provided included:

No. Programme Title Participants

1 Basic: Shariah and Islamic Finance (SAIF) 167

2 Intermediate: Islamic Finance Essentials (IFE) 170

3 Advance: Certification Islamic Finance Program (CIFP) 23

DISCLOSURE ON SHARIAH NON-COMPLIANT EVENT

Throughout 2024, we had confirmed the following two (2) incidents of Actual SNC event to the Bank:

Nature of Events Measures Undertaken

Collection of profit prior to execution of Tawarruq transaction. Nonetheless, The Bank has taken measures to strengthen -

the Shariah Committee of the view that the incident did not have any financial the relevant policies and procedures

implication to the Bank in view that the upfront collected profit was off-set by

the later Tawarruq.

Accidental Investment of Islamic Cash Collateral in Conventional Money A sum of AUD54,295.06 (RM153,020.00)

Market Instrument. As a result, the Shariah Committee had decided that the interest income has been de-recognized by

Shariah Non-Compliance income shall be de-recognized from the income and channelling for charitable cause. The Bank

channelled to charitable cause. has taken measures to enhance the Standard

Operating Procedures