Page 243 - Exim iar24_Ebook

P. 243

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 241

NOTES TO THE FINANCIAL STATEMENTS

44. ISLAMIC BUSINESS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2024

(cont’d)

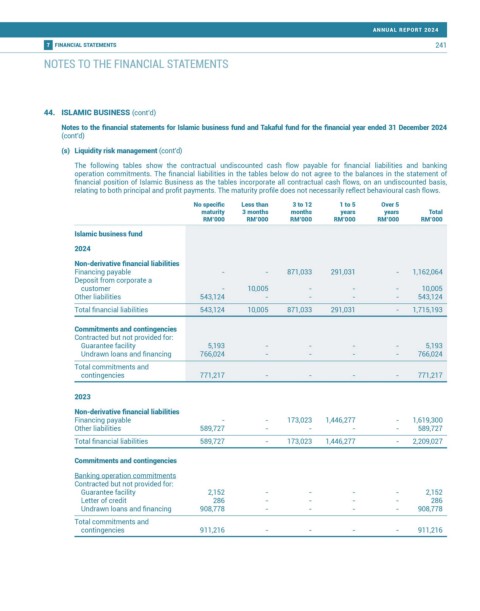

(s) Liquidity risk management (cont’d)

The following tables show the contractual undiscounted cash flow payable for financial liabilities and banking

operation commitments. The financial liabilities in the tables below do not agree to the balances in the statement of

financial position of Islamic Business as the tables incorporate all contractual cash flows, on an undiscounted basis,

relating to both principal and profit payments. The maturity profile does not necessarily reflect behavioural cash flows.

No specific Less than 3 to 12 1 to 5 Over 5

maturity 3 months months years years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Islamic business fund

2024

Non-derivative financial liabilities

Financing payable - - 871,033 291,031 - 1,162,064

Deposit from corporate a

customer - 10,005 - - - 10,005

Other liabilities 543,124 - - - - 543,124

Total financial liabilities 543,124 10,005 871,033 291,031 - 1,715,193

Commitments and contingencies

Contracted but not provided for:

Guarantee facility 5,193 - - - - 5,193

Undrawn loans and financing 766,024 - - - - 766,024

Total commitments and

contingencies 771,217 - - - - 771,217

2023

Non-derivative financial liabilities

Financing payable - - 173,023 1,446,277 - 1,619,300

Other liabilities 589,727 - - - - 589,727

Total financial liabilities 589,727 - 173,023 1,446,277 - 2,209,027

Commitments and contingencies

Banking operation commitments

Contracted but not provided for:

Guarantee facility 2,152 - - - - 2,152

Letter of credit 286 - - - - 286

Undrawn loans and financing 908,778 - - - - 908,778

Total commitments and

contingencies 911,216 - - - - 911,216