Page 245 - Exim iar24_Ebook

P. 245

EXIM BANK MALAYSIA ANNUAL REPORT 2024

7 FINANCIAL STATEMENTS 243

NOTES TO THE FINANCIAL STATEMENTS

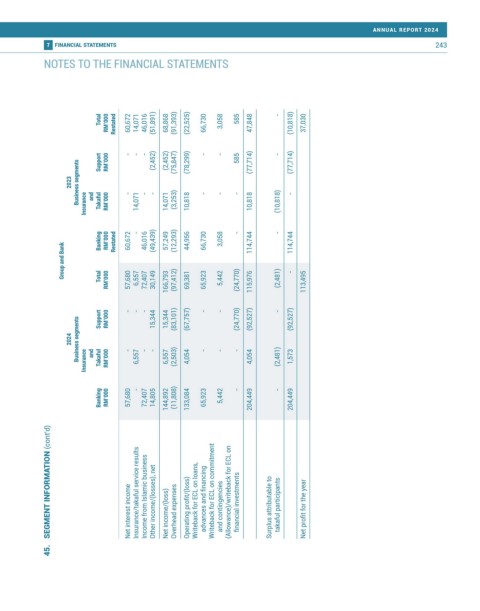

Total RM’000 Restated 60,672 14,071 46,016 (51,891) 68,868 (91,393) (22,525) 66,730 3,058 585 47,848 - (10,818) 37,030

Business segments Insurance and Takaful RM’000 - 14,071 - - 14,071 (3,253) 10,818 - - - 10,818 (10,818) -

2023 Support RM’000 - - - (2,452) (2,452) (75,847) (78,299) - - 585 (77,714) - (77,714)

Banking RM’000 Restated 60,672 - 46,016 (49,439) 57,249 (12,293) 44,956 66,730 3,058 - 114,744 - 114,744

Group and Bank Total RM’000 57,680 6,557 72,407 30,149 166,793 (97,412) 69,381 65,923 5,442 (24,770) 115,976 (2,481) - 113,495

Business segments Support RM’000 - - - 15,344 15,344 (83,101) (67,757) - - (24,770) (92,527) - (92,527)

2024 Insurance and Takaful RM’000 - 6,557 - - 6,557 (2,503) 4,054 - - - 4,054 (2,481) 1,573

Banking RM’000 57,680 - 72,407 14,805 144,892 (11,808) 133,084 65,923 5,442 - 204,449 - 204,449

SEGMENT INFORMATION (cont’d) Net interest income Insurance/takaful service results Income from Islamic business Other income/(losses), net Net income/(loss) Overhead expenses Operating profit/(loss) Writeback for ECL on loans, advances and financing Writeback for ECL on commitment and contingencies (Allowance)/writeback for ECL on financial investments Surplus attributable to takaful participants Net profit for the year

45.