Page 69 - Exim iar24_Ebook

P. 69

EXIM BANK MALAYSIA ANNUAL REPORT 2024

6 UPHOLDING ACCOUNTABILITY 67

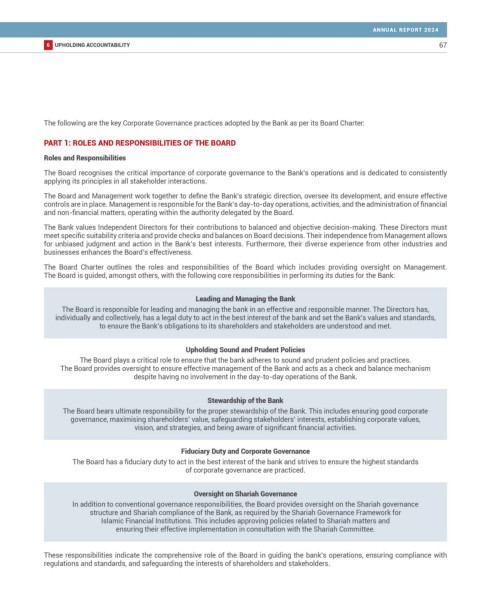

The following are the key Corporate Governance practices adopted by the Bank as per its Board Charter:

PART 1: ROLES AND RESPONSIBILITIES OF THE BOARD

Roles and Responsibilities

The Board recognises the critical importance of corporate governance to the Bank’s operations and is dedicated to consistently

applying its principles in all stakeholder interactions.

The Board and Management work together to define the Bank’s strategic direction, oversee its development, and ensure effective

controls are in place. Management is responsible for the Bank’s day-to-day operations, activities, and the administration of financial

and non-financial matters, operating within the authority delegated by the Board.

The Bank values Independent Directors for their contributions to balanced and objective decision-making. These Directors must

meet specific suitability criteria and provide checks and balances on Board decisions. Their independence from Management allows

for unbiased judgment and action in the Bank’s best interests. Furthermore, their diverse experience from other industries and

businesses enhances the Board’s effectiveness.

The Board Charter outlines the roles and responsibilities of the Board which includes providing oversight on Management.

The Board is guided, amongst others, with the following core responsibilities in performing its duties for the Bank:

Leading and Managing the Bank

The Board is responsible for leading and managing the bank in an effective and responsible manner. The Directors has,

individually and collectively, has a legal duty to act in the best interest of the bank and set the Bank’s values and standards,

to ensure the Bank’s obligations to its shareholders and stakeholders are understood and met.

Upholding Sound and Prudent Policies

The Board plays a critical role to ensure that the bank adheres to sound and prudent policies and practices.

The Board provides oversight to ensure effective management of the Bank and acts as a check and balance mechanism

despite having no involvement in the day-to-day operations of the Bank.

Stewardship of the Bank

The Board bears ultimate responsibility for the proper stewardship of the Bank. This includes ensuring good corporate

governance, maximising shareholders’ value, safeguarding stakeholders’ interests, establishing corporate values,

vision, and strategies, and being aware of significant financial activities.

Fiduciary Duty and Corporate Governance

The Board has a fiduciary duty to act in the best interest of the bank and strives to ensure the highest standards

of corporate governance are practiced.

Oversight on Shariah Governance

In addition to conventional governance responsibilities, the Board provides oversight on the Shariah governance

structure and Shariah compliance of the Bank, as required by the Shariah Governance Framework for

Islamic Financial Institutions. This includes approving policies related to Shariah matters and

ensuring their effective implementation in consultation with the Shariah Committee.

These responsibilities indicate the comprehensive role of the Board in guiding the bank’s operations, ensuring compliance with

regulations and standards, and safeguarding the interests of shareholders and stakeholders.