Page 96 - Exim iar24_Ebook

P. 96

EXIM BANK MALAYSIA

94

STATEMENT OF

RISK MANAGEMENT

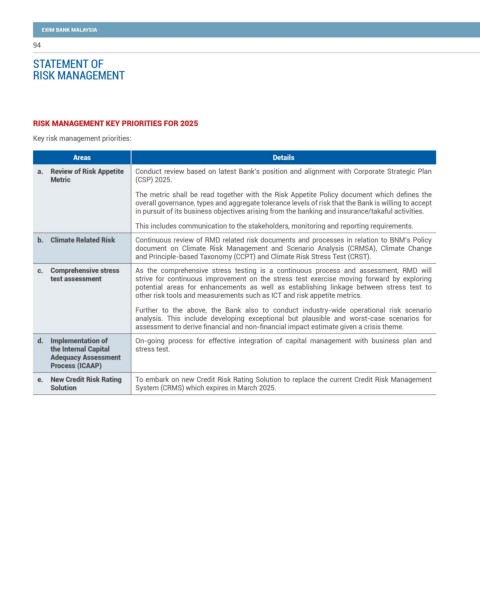

RISK MANAGEMENT KEY PRIORITIES FOR 2025

Key risk management priorities:

Areas Details

a. Review of Risk Appetite Conduct review based on latest Bank’s position and alignment with Corporate Strategic Plan

Metric (CSP) 2025.

The metric shall be read together with the Risk Appetite Policy document which defines the

overall governance, types and aggregate tolerance levels of risk that the Bank is willing to accept

in pursuit of its business objectives arising from the banking and insurance/takaful activities.

This includes communication to the stakeholders, monitoring and reporting requirements.

b. Climate Related Risk Continuous review of RMD related risk documents and processes in relation to BNM’s Policy

document on Climate Risk Management and Scenario Analysis (CRMSA), Climate Change

and Principle-based Taxonomy (CCPT) and Climate Risk Stress Test (CRST).

c. Comprehensive stress As the comprehensive stress testing is a continuous process and assessment, RMD will

test assessment strive for continuous improvement on the stress test exercise moving forward by exploring

potential areas for enhancements as well as establishing linkage between stress test to

other risk tools and measurements such as ICT and risk appetite metrics.

Further to the above, the Bank also to conduct industry-wide operational risk scenario

analysis. This include developing exceptional but plausible and worst-case scenarios for

assessment to derive financial and non-financial impact estimate given a crisis theme.

d. Implementation of On-going process for effective integration of capital management with business plan and

the Internal Capital stress test.

Adequacy Assessment

Process (ICAAP)

e. New Credit Risk Rating To embark on new Credit Risk Rating Solution to replace the current Credit Risk Management

Solution System (CRMS) which expires in March 2025.