From left: Wan Noorazli Maula Wan Suleiman, MEXIM Head of Legal; Zabedah Giw, MEXIM Acting Chief Strategy Officer; Norlela Sulaiman, MEXIM Chief Operating Officer; Nurshazwani Abd Malek, MEXIM Acting Head of Finance & Accounting; and Chin Ying Jack, MEXIM Chief Risk Officer.

Kuala Lumpur, Malaysia 19 November 2021 – Export-Import Bank of Malaysia Berhad (“MEXIM” or the “Bank”) has successfully returned to the international capital markets and priced a U.S. dollar bond offering of USD350 million 5-year Senior Unsecured Notes (the “Notes”). The Notes are issued off MEXIM’s USD3.0 billion Multicurrency Medium Term Note Programme.

Taking advantage of a steady market open in Asia on the morning of 18 November 2021, MEXIM opportunistically entered the global market, announcing an initial price guidance at T+90bps area for the Notes. MEXIM was able to compress the initial price guidance by 30bps and announce final price guidance at T+60bps area. The Notes were subsequently priced at T+60bps at a yield of 1.831%.

MEXIM’s offering was conducted on the back of a comprehensive global virtual investor roadshow conducted on 17 November 2021 following a mandate announcement on the day before.

The final order size amounted to over US$1.3 billion over 80 accounts (including US$100 million from the joint bookrunners), or an oversubscription rate of more than 3.7x of MEXIM’s target USD350 million issuance.

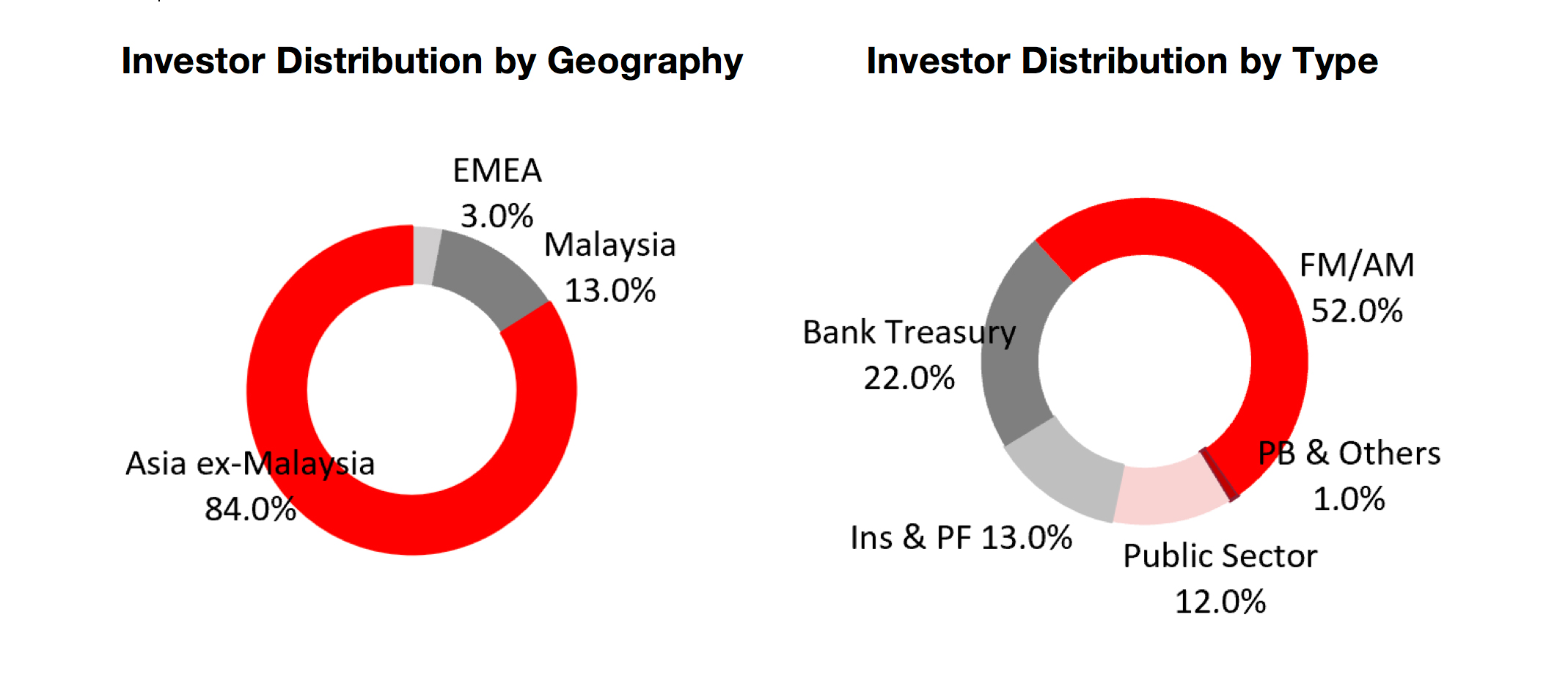

The Notes were allocated 13% to Malaysia, 84% to Asia ex-Malaysia and 3% to EMEA. By investor type, 52% was allocated to asset managers, 22% to bank treasuries, 13% to insurance and pension funds, 12% to public sector and the remaining 1% to private banks and other investors.

The Notes are expected to settle on 26 November 2021. Net proceeds will be used for MEXIM’s general banking and finance activities, working capital, as well as other corporate purposes. The Notes are expected to be rated A3 by Moody’s and will be listed on Singapore Exchange Securities Trading Limited and Labuan International Financial Exchange Inc.

Dato’ Azman Mahmud’s recent appointment as the Chairman of MEXIM gives much credence and inspires investors’ confidence in the Bank. He said: “MEXIM’s successful return to the international capital markets exemplifies the trust and support of international investors towards the strong credit fundamentals of MEXIM, as well as its role in continuing the recovery of the Malaysian economy, following the COVID-19 pandemic. As the only Development Financial Institution mandated by the Malaysian government to promote the development of cross-border ventures, the Bank’s role remains vital to facilitate the competitiveness of Malaysian institutions.”

Growing confidence in the Bank can also be seen when MEXIM successfully redeemed its USD500 million senior unsecured notes that was due in late October this year.

Norlela Sulaiman, MEXIM Chief Operating Officer, also added: “MEXIM was able to capitalise on an opportunistic market window available despite the volatile movement of the broader market environment. This underpins the confidence of international investors towards the integral mandated role of MEXIM in the country’s export-oriented economy.”

The Hongkong and Shanghai Banking Corporation acted as the Sole Global Coordinator, as well as one of the Joint Lead Managers together with CIMB Investment Bank Berhad, Citigroup Global Markets Limited and Standard Chartered Bank (Singapore) Limited (together, the “Joint Lead Managers”).

IMPORTANT NOTICE

This news release is for information purposes only and does not constitute or form part of an offer, solicitation, recommendation or invitation of any offer, to buy or subscribe for any securities of the Bank in any jurisdiction, nor should it or any part of it form the basis of, or be relied on in connection with, any investment decision, contract or commitment whatsoever.

This news release may contain forward-looking statements or financial information that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Predictions, projections or forecasts of the economy or economic trends of the markets are not necessarily indicative of the future or likely performance of the Bank. The forecast financial performance or financial information of the Bank is not guaranteed. A potential investor is cautioned not to place undue reliance on these forward-looking statements or financial information, which are based on the Bank’s current view of future events.

This news release is not, and the information contained herein are not and do not constitute or form part of, and should not be construed as, an offer to purchase, a solicitation of an offer to

purchase, an offer to sell or an invitation or solicitation of an offer to sell, issue or subscribe for an offer or sale of any securities mentioned herein in the United States or in any other jurisdiction where such offer, invitation or solicitation would be unlawful. Any securities mentioned herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”) and may not be offered or sold in the United States absent registration except pursuant to an exemption from, or in a transaction not subject to, the registration requirements under the Securities Act. Any public offering of any securities mentioned herein in the United States would be made by means of a prospectus that would contain detailed information about the Bank, its management as well as financial statements. There is no intention to register any securities referred to herein in the United States or to make a public offering of any securities referred to herein in the United States or in any other jurisdiction where such an offering is restricted or prohibited or where such an offering would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.