Page 195 - EXIM_AR2021

P. 195

ANNUAL REPORT 2021 193

Notes to the fiNaNcial statemeNts

42. financial risk management POlicies (cOnt’D.)

Credit risk exposure (cont’d.)

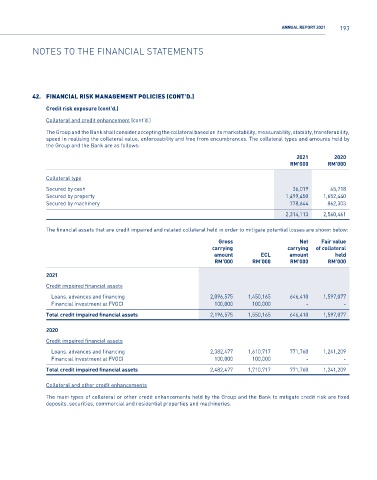

Collateral and credit enhancement (cont’d.)

The Group and the Bank shall consider accepting the collateral based on its marketability, measurability, stability, transferability,

speed in realising the collateral value, enforceability and free from encumbrances. The collateral types and amounts held by

the Group and the Bank are as follows:

2021 2020

RM’000 RM’000

Collateral type

Secured by cash 36,019 45,718

Secured by property 1,499,450 1,652,440

Secured by machinery 778,644 862,303

2,314,113 2,560,461

The financial assets that are credit impaired and related collateral held in order to mitigate potential losses are shown below:

Gross Net Fair value

carrying carrying of collateral

amount ECL amount held

RM’000 RM’000 RM’000 RM’000

2021

Credit impaired financial assets

Loans, advances and financing 2,096,575 1,450,165 646,410 1,597,077

Financial investment at FVOCI 100,000 100,000 - -

Total credit impaired financial assets 2,196,575 1,550,165 646,410 1,597,077

2020

Credit impaired financial assets

Loans, advances and financing 2,382,477 1,610,717 771,760 1,241,209

Financial investment at FVOCI 100,000 100,000 - -

Total credit impaired financial assets 2,482,477 1,710,717 771,760 1,241,209

Collateral and other credit enhancements

The main types of collateral or other credit enhancements held by the Group and the Bank to mitigate credit risk are fixed

deposits, securities, commercial and residential properties and machineries.