Page 216 - EXIM_AR2021

P. 216

214 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

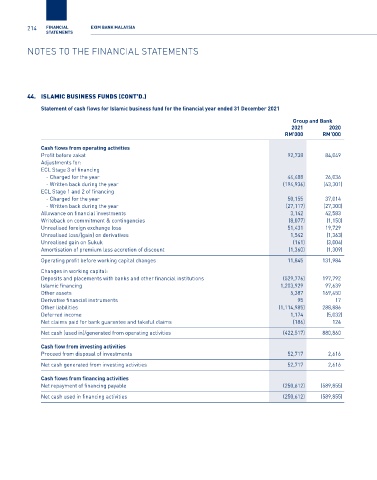

44. islamic bUsiness fUnDs (cOnt’D.)

Statement of cash flows for Islamic business fund for the financial year ended 31 December 2021

Group and Bank

2021 2020

RM’000 RM’000

Cash flows from operating activities

Profit before zakat 92,738 84,049

Adjustments for:

ECL Stage 3 of financing

- Charged for the year 44,488 26,036

- Written back during the year (194,936) (43,301)

ECL Stage 1 and 2 of financing

- Charged for the year 50,155 37,014

- Written back during the year (27,117) (27,300)

Allowance on financial investments 3,142 42,583

Writeback on commitment & contingencies (8,077) (1,150)

Unrealised foreign exchange loss 51,431 19,729

Unrealised loss/(gain) on derivatives 1,542 (1,363)

Unrealised gain on Sukuk (161) (3,004)

Amortisation of premium less accretion of discount (1,360) (1,309)

Operating profit before working capital changes 11,845 131,984

Changes in working capital:

Deposits and placements with banks and other financial institutions (529,776) 197,792

Islamic financing 1,203,929 97,639

Other assets 5,387 169,450

Derivative financial instruments 95 17

Other liabilities (1,114,985) 288,886

Deferred income 1,174 (5,032)

Net claims paid for bank guarantee and takaful claims (186) 124

Net cash (used in)/generated from operating activities (422,517) 880,860

Cash flow from investing activities

Proceed from disposal of investments 52,717 2,616

Net cash generated from investing activities 52,717 2,616

Cash flows from financing activities

Net repayment of financing payable (250,612) (589,855)

Net cash used in financing activities (250,612) (589,855)