Page 231 - EXIM_AR2021

P. 231

ANNUAL REPORT 2021 229

Notes to the fiNaNcial statemeNts

44. islamic bUsiness fUnDs (cOnt’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2021

(cont’d.)

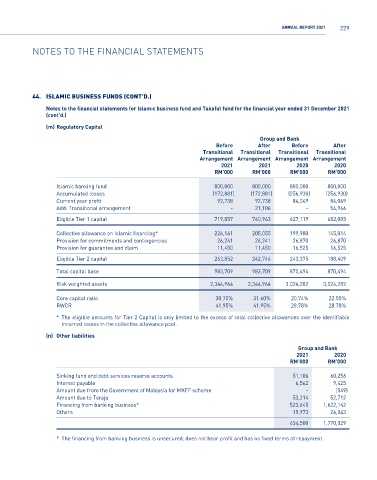

(m) Regulatory Capital

Group and Bank

Before After Before After

Transitional Transitional Transitional Transitional

Arrangement Arrangement Arrangement Arrangement

2021 2021 2020 2020

RM’000 RM’000 RM’000 RM’000

Islamic banking fund 800,000 800,000 800,000 800,000

Accumulated losses (172,881) (172,881) (256,930) (256,930)

Current year profit 92,738 92,738 84,049 84,049

Add: Transitional arrangement - 21,106 - 54,966

Eligible Tier 1 capital 719,857 740,963 627,119 682,085

Collective allowance on Islamic financing* 226,161 205,055 199,980 145,014

Provision for commitments and contingencies 26,241 26,241 26,870 26,870

Provision for guarantee and claim 11,450 11,450 16,525 16,525

Eligible Tier 2 capital 263,852 242,746 243,375 188,409

Total capital base 983,709 983,709 870,494 870,494

Risk weighted assets 2,344,964 2,344,964 3,024,282 3,024,282

Core capital ratio 30.70% 31.60% 20.74% 22.55%

RWCR 41.95% 41.95% 28.78% 28.78%

* The eligible amounts for Tier 2 Capital is only limited to the excess of total collective allowances over the identifiable

incurred losses in the collective allowance pool.

(n) Other liabilities

Group and Bank

2021 2020

RM’000 RM’000

Sinking fund and debt services reserve accounts 51,106 60,256

Interest payable 6,562 9,425

Amount due from the Government of Malaysia for MKFF scheme - (549)

Amount due to Teraju 53,214 52,712

Financing from banking business* 523,645 1,622,142

Others 19,973 26,043

654,500 1,770,029

* The financing from banking business is unsecured, does not bear profit and has no fixed terms of repayment.