Page 228 - EXIM_AR2021

P. 228

226 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

44. islamic bUsiness fUnDs (cOnt’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2021

(cont’d.)

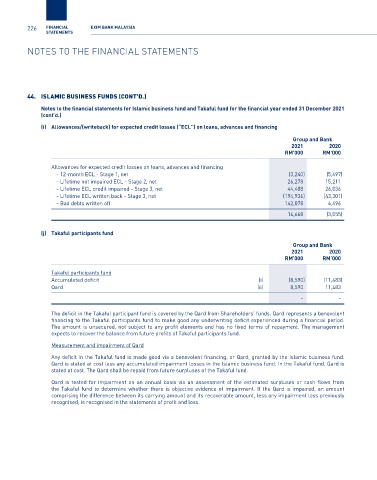

(i) Allowances/(writeback) for expected credit losses (“ECL”) on loans, advances and financing

Group and Bank

2021 2020

RM’000 RM’000

Allowances for expected credit losses on loans, advances and financing

- 12-month ECL - Stage 1, net (3,240) (5,497)

- Lifetime not impaired ECL - Stage 2, net 26,278 15,211

- Lifetime ECL credit impaired - Stage 3, net 44,488 26,036

- Lifetime ECL written back - Stage 3, net (194,936) (43,301)

- Bad debts written off 142,078 4,496

14,668 (3,055)

(j) Takaful participants fund

Group and Bank

2021 2020

RM’000 RM’000

Takaful participants fund

Accumulated deficit (i) (8,590) (11,483)

Qard (ii) 8,590 11,483

- -

The deficit in the Takaful participant fund is covered by the Qard from Shareholders’ funds. Qard represents a benevolent

financing to the Takaful participants fund to make good any underwriting deficit experienced during a financial period.

The amount is unsecured, not subject to any profit elements and has no fixed terms of repayment. The management

expects to recover the balance from future profits of Takaful participants fund.

Measurement and impairment of Qard

Any deficit in the Takaful fund is made good via a benevolent financing, or Qard, granted by the Islamic business fund.

Qard is stated at cost less any accumulated impairment losses in the Islamic business fund. In the Takaful fund, Qard is

stated at cost. The Qard shall be repaid from future surpluses of the Takaful fund.

Qard is tested for impairment on an annual basis via an assessment of the estimated surpluses or cash flows from

the Takaful fund to determine whether there is objective evidence of impairment. If the Qard is impaired, an amount

comprising the difference between its carrying amount and its recoverable amount, less any impairment loss previously

recognised, is recognised in the statements of profit and loss.