Page 224 - EXIM_AR2021

P. 224

222 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

44. islamic bUsiness fUnDs (cOnt’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2021

(cont’d.)

(d) Islamic financing (cont’d.)

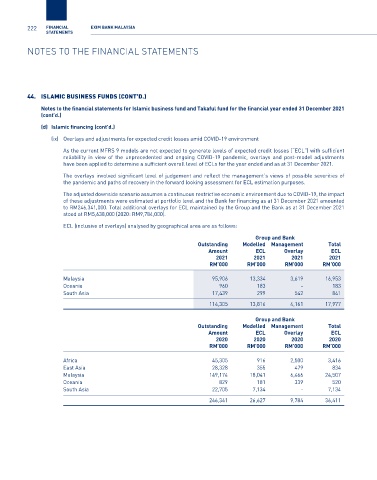

(ix) Overlays and adjustments for expected credit losses amid COVID-19 environment

As the current MFRS 9 models are not expected to generate levels of expected credit losses (“ECL”) with sufficient

reliability in view of the unprecedented and ongoing COVID-19 pandemic, overlays and post-model adjustments

have been applied to determine a sufficient overall level of ECLs for the year ended and as at 31 December 2021.

The overlays involved significant level of judgement and reflect the management’s views of possible severities of

the pandemic and paths of recovery in the forward looking assessment for ECL estimation purposes.

The adjusted downside scenario assumes a continuous restrictive economic environment due to COVID-19, the impact

of these adjustments were estimated at portfolio level and the Bank for financing as at 31 December 2021 amounted

to RM246,341,000. Total additional overlays for ECL maintained by the Group and the Bank as at 31 December 2021

stood at RM5,638,000 (2020: RM9,784,000).

ECL (inclusive of overlays) analysed by geographical area are as follows:

Group and Bank

Outstanding Modelled Management Total

Amount ECL Overlay ECL

2021 2021 2021 2021

RM’000 RM’000 RM’000 RM’000

Malaysia 95,906 13,334 3,619 16,953

Oceania 960 183 - 183

South Asia 17,439 299 542 841

114,305 13,816 4,161 17,977

Group and Bank

Outstanding Modelled Management Total

Amount ECL Overlay ECL

2020 2020 2020 2020

RM’000 RM’000 RM’000 RM’000

Africa 45,305 916 2,500 3,416

East Asia 28,328 355 479 834

Malaysia 149,174 18,041 6,466 24,507

Oceania 829 181 339 520

South Asia 22,705 7,134 - 7,134

246,341 26,627 9,784 36,411