Page 41 - EXIM_AR2021

P. 41

ANNUAL REPORT 2021 39

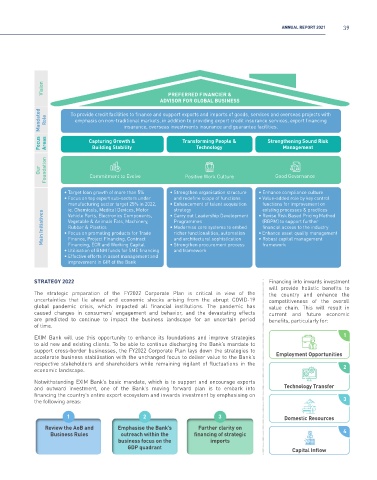

Vision PREFERRED FINANCIER &

ADVISOR FOR GLOBAL BUSINESS

Mandated Role To provide credit facilities to finance and support exports and imports of goods, services and overseas projects with

emphasis on non-traditional markets, in addition to providing export credit insurance services, export financing

insurance, overseas investments insurance and guarantee facilities.

Focus Areas Capturing Growth & Transforming People & Strengthening Sound Risk

Technology

Building Stability

Management

Foundation Commitment to Evolve Positive Work Culture Good Governance

Our

• Target loan growth of more than 5% • Strengthen organisation structure • Enhance compliance culture

• Focus on top export sub-sectors under and redefine scope of functions • Value-added role by key control

manufacturing sector target 25% in 2022, • Enhancement of talent acquisition functions for improvement on

existing processes & practices

strategy

ie. Chemicals, Medical Devices, Motor • Carry out Leadership Development • Revise Risk Based Pricing Method

Main Initiatives • Focus on promoting products for Trade • Modernise core systems to embed • Enhance asset quality management

Vehicle Parts, Electronics Components,

Vegetable & Animals Fats, Machinery,

Programmes

(RBPM) to support further

financial access to the industry

Rubber & Plastics

richer functionalities, automation

• Robust capital management

and architectural sophistication

Finance, Project Financing, Contract

Financing, ECR and Working Capital

and framework

• Utilisation of BNM funds for SME financing • Strengthen procurement process framework

• Effective efforts in asset management and

improvement in GIR of the Bank

STRATEGY 2022 Financing into inwards investment

will provide holistic benefits to

The strategic preparation of the FY2022 Corporate Plan is critical in view of the the country and enhance the

uncertainties that lie ahead and economic shocks arising from the abrupt COVID-19 competitiveness of the overall

global pandemic crisis, which impacted all financial institutions. The pandemic has value chain. This will result in

caused changes in consumers’ engagement and behavior, and the devastating effects current and future economic

are predicted to continue to impact the business landscape for an uncertain period benefits, particularly for:

of time.

EXIM Bank will use this opportunity to enhance its foundations and improve strategies 1

to aid new and existing clients. To be able to continue discharging the Bank’s mandate to

support cross-border businesses, the FY2022 Corporate Plan lays down the strategies to

accelerate business stabilisation with the unchanged focus to deliver value to the Bank’s Employment Opportunities

respective stakeholders and shareholders while remaining vigilant of fluctuations in the

economic landscape. 2

Notwithstanding EXIM Bank’s basic mandate, which is to support and encourage exports

and outward investment, one of the Bank’s moving forward plan is to embark into Technology Transfer

financing the country’s entire export ecosystem and inwards investment by emphasising on

the following areas: 3

1 2 3 Domestic Resources

Review the AoB and Emphasise the Bank’s Further clarity on

Business Rules outreach within the financing of strategic 4

business focus on the imports

GDP quadrant Capital Inflow