Page 175 - EXIM-Bank_Annual-Report-2022

P. 175

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 173

Notes to the fiNaNcial statemeNts

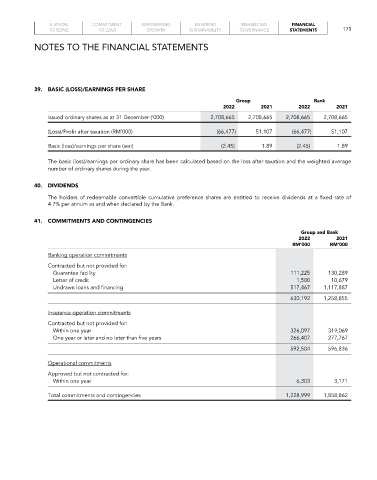

39. BaSIC (LOSS)/EaRNINGS PER SHaRE

Group Bank

2022 2021 2022 2021

Issued ordinary shares as at 31 December (‘000) 2,708,665 2,708,665 2,708,665 2,708,665

(Loss)/Profit after taxation (RM’000) (66,477) 51,107 (66,477) 51,107

Basic (loss)/earnings per share (sen) (2.45) 1.89 (2.45) 1.89

The basic (loss)/earnings per ordinary share has been calculated based on the loss after taxation and the weighted average

number of ordinary shares during the year.

40. DIVIDENDS

The holders of redeemable convertible cumulative preference shares are entitled to receive dividends at a fixed rate of

4.7% per annum as and when declared by the Bank.

41. COMMITMENTS aND CONTINGENCIES

Group and Bank

2022 2021

rM’000 rM’000

Banking operation commitments

Contracted but not provided for:

Guarantee facility 111,225 130,289

Letter of credit 1,500 10,679

Undrawn loans and financing 517,467 1,117,887

630,192 1,258,855

Insurance operation commitments

Contracted but not provided for:

Within one year 326,097 319,069

One year or later and no later than five years 266,407 277,767

592,504 596,836

Operational commitments

Approved but not contracted for:

Within one year 6,303 3,171

Total commitments and contingencies 1,228,999 1,858,862