Page 176 - EXIM-Bank_Annual-Report-2022

P. 176

174 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

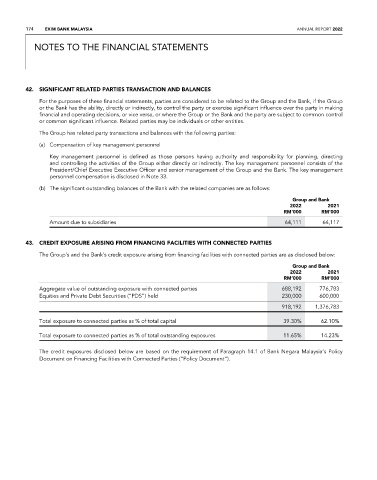

42. SIGNIFICaNT RELaTED PaRTIES TRaNSaCTION aND BaLaNCES

For the purposes of these financial statements, parties are considered to be related to the Group and the Bank, if the Group

or the Bank has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making

financial and operating decisions, or vice versa, or where the Group or the Bank and the party are subject to common control

or common significant influence. Related parties may be individuals or other entities.

The Group has related party transactions and balances with the following parties:

(a) Compensation of key management personnel

Key management personnel is defined as those persons having authority and responsibility for planning, directing

and controlling the activities of the Group either directly or indirectly. The key management personnel consists of the

President/Chief Executive Executive Officer and senior management of the Group and the Bank. The key management

personnel compensation is disclosed in Note 33.

(b) The significant outstanding balances of the Bank with the related companies are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Amount due to subsidiaries 64,111 64,117

43. CREDIT EXPOSURE aRISING FROM FINaNCING FaCILITIES WITH CONNECTED PaRTIES

The Group’s and the Bank’s credit exposure arising from financing facilities with connected parties are as disclosed below:

Group and Bank

2022 2021

rM’000 rM’000

Aggregate value of outstanding exposure with connected parties 688,192 776,783

Equities and Private Debt Securities (“PDS”) held 230,000 600,000

918,192 1,376,783

Total exposure to connected parties as % of total capital 39.30% 62.10%

Total exposure to connected parties as % of total outstanding exposures 11.65% 14.23%

The credit exposures disclosed below are based on the requirement of Paragraph 14.1 of Bank Negara Malaysia’s Policy

Document on Financing Facilities with Connected Parties (“Policy Document”).