Page 179 - EXIM-Bank_Annual-Report-2022

P. 179

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 177

Notes to the fiNaNcial statemeNts

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Capital management (cont’d.)

Regulatory capital

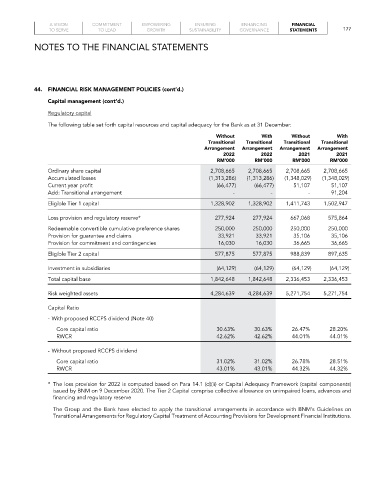

The following table set forth capital resources and capital adequacy for the Bank as at 31 December:

Without With Without With

transitional transitional transitional transitional

Arrangement Arrangement Arrangement Arrangement

2022 2022 2021 2021

rM’000 rM’000 rM’000 rM’000

Ordinary share capital 2,708,665 2,708,665 2,708,665 2,708,665

Accumulated losses (1,313,286) (1,313,286) (1,348,029) (1,348,029)

Current year profit (66,477) (66,477) 51,107 51,107

Add: Transitional arrangement - - - 91,204

Eligible Tier 1 capital 1,328,902 1,328,902 1,411,743 1,502,947

Loss provision and regulatory reserve* 277,924 277,924 667,068 575,864

Redeemable convertible cumulative preference shares 250,000 250,000 250,000 250,000

Provision for guarantee and claims 33,921 33,921 35,106 35,106

Provision for commitment and contingencies 16,030 16,030 36,665 36,665

Eligible Tier 2 capital 577,875 577,875 988,839 897,635

Investment in subsidiaries (64,129) (64,129) (64,129) (64,129)

Total capital base 1,842,648 1,842,648 2,336,453 2,336,453

Risk weighted assets 4,284,639 4,284,639 5,271,754 5,271,754

Capital Ratio

- With proposed RCCPS dividend (Note 40)

Core capital ratio 30.63% 30.63% 26.47% 28.20%

RWCR 42.62% 42.62% 44.01% 44.01%

- Without proposed RCCPS dividend

Core capital ratio 31.02% 31.02% 26.78% 28.51%

RWCR 43.01% 43.01% 44.32% 44.32%

* The loss provision for 2022 is computed based on Para 14.1 (d)(ii) or Capital Adequacy Framework (capital components)

issued by BNM on 9 December 2020. The Tier 2 Capital comprise collective allowance on unimpaired loans, advances and

financing and regulatory reserve

The Group and the Bank have elected to apply the transitional arrangements in accordance with BNM’s Guidelines on

Transitional Arrangements for Regulatory Capital Treatment of Accounting Provisions for Development Financial Institutions.