Page 181 - EXIM-Bank_Annual-Report-2022

P. 181

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 179

Notes to the fiNaNcial statemeNts

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Market risk management (cont’d.)

Measurement (cont’d.)

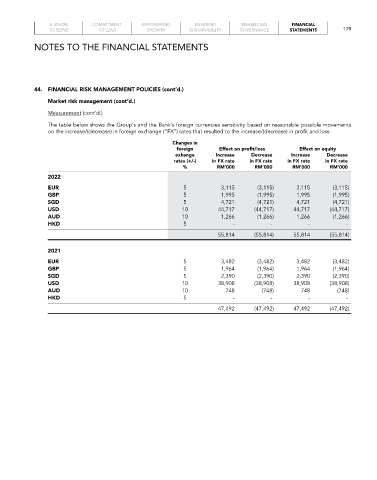

The table below shows the Group’s and the Bank’s foreign currencies sensitivity based on reasonable possible movements

on the increase/(decrease) in foreign exchange (“FX”) rates that resulted to the increase/(decrease) in profit and loss:

Changes in

foreign Effect on profit/loss Effect on equity

exhange Increase Decrease Increase Decrease

rates (+/-) in FX rate in FX rate in FX rate in FX rate

% RM’000 RM’000 RM’000 RM’000

2022

eur 5 3,115 (3,115) 3,115 (3,115)

GBP 5 1,995 (1,995) 1,995 (1,995)

sGD 5 4,721 (4,721) 4,721 (4,721)

usD 10 44,717 (44,717) 44,717 (44,717)

AuD 10 1,266 (1,266) 1,266 (1,266)

hKD 5 - - - -

55,814 (55,814) 55,814 (55,814)

2021

eur 5 3,482 (3,482) 3,482 (3,482)

GBP 5 1,964 (1,964) 1,964 (1,964)

sGD 5 2,390 (2,390) 2,390 (2,390)

usD 10 38,908 (38,908) 38,908 (38,908)

AuD 10 748 (748) 748 (748)

hKD 5 - - - -

47,492 (47,492) 47,492 (47,492)