Page 224 - EXIM-Bank_Annual-Report-2022

P. 224

222 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

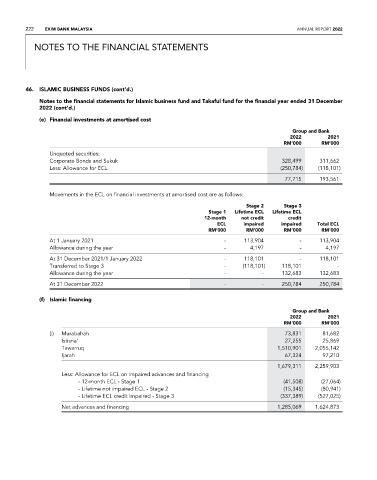

(e) Financial investments at amortised cost

Group and Bank

2022 2021

rM’000 rM’000

Unquoted securities:

Corporate Bonds and Sukuk 328,499 311,662

Less: Allowance for ECL (250,784) (118,101)

77,715 193,561

Movements in the ECL on financial investments at amortised cost are as follows:

stage 2 stage 3

stage 1 Lifetime eCL Lifetime eCL

12-month not credit credit

eCL impaired impaired total eCL

rM’000 rM’000 rM’000 rM’000

At 1 January 2021 - 113,904 - 113,904

Allowance during the year - 4,197 - 4,197

At 31 December 2021/1 January 2022 - 118,101 - 118,101

Transferred to Stage 3 - (118,101) 118,101 -

Allowance during the year - - 132,683 132,683

At 31 December 2022 - - 250,784 250,784

(f) Islamic financing

Group and Bank

2022 2021

rM’000 rM’000

(i) Murabahah 73,831 81,682

Istisna’ 27,255 25,869

Tawarruq 1,510,901 2,055,142

Ijarah 67,324 97,210

1,679,311 2,259,903

Less: Allowance for ECL on impaired advances and financing

- 12-month ECL - Stage 1 (41,508) (27,064)

- Lifetime not impaired ECL - Stage 2 (15,345) (80,941)

- Lifetime ECL credit impaired - Stage 3 (337,389) (527,025)

Net advances and financing 1,285,069 1,624,873