Page 225 - EXIM-Bank_Annual-Report-2022

P. 225

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 223

Notes to the fiNaNcial statemeNts

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

(f) Islamic financing (cont’d.)

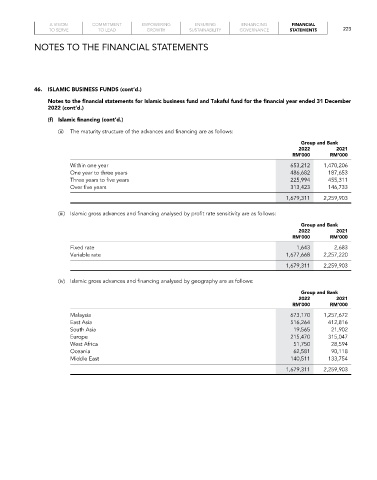

(ii) The maturity structure of the advances and financing are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Within one year 653,212 1,470,206

One year to three years 486,682 187,653

Three years to five years 225,994 455,311

Over five years 313,423 146,733

1,679,311 2,259,903

(iii) Islamic gross advances and financing analysed by profit rate sensitivity are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Fixed rate 1,643 2,683

Variable rate 1,677,668 2,257,220

1,679,311 2,259,903

(iv) Islamic gross advances and financing analysed by geography are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Malaysia 673,170 1,257,672

East Asia 516,264 412,816

South Asia 19,565 21,902

Europe 215,470 315,047

West Africa 51,750 28,594

Oceania 62,581 90,118

Middle East 140,511 133,754

1,679,311 2,259,903