Page 220 - EXIM-Bank_Annual-Report-2022

P. 220

218 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

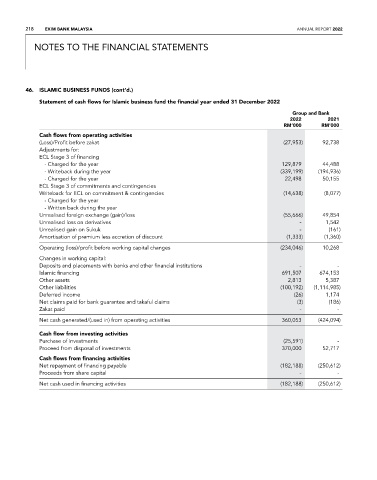

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Statement of cash flows for Islamic business fund the financial year ended 31 December 2022

Group and Bank

2022 2021

rM’000 rM’000

Cash flows from operating activities

(Loss)/Profit before zakat (27,953) 92,738

Adjustments for:

ECL Stage 3 of financing

- Charged for the year 129,879 44,488

- Writeback during the year (339,199) (194,936)

- Charged for the year 22,498 50,155

ECL Stage 3 of commitments and contingencies

Writeback for ECL on commitment & contingencies (14,638) (8,077)

- Charged for the year

- Written back during the year

Unrealised foreign exchange (gain)/loss (55,666) 49,854

Unrealised loss on derivatives - 1,542

Unrealised gain on Sukuk - (161)

Amortisation of premium less accretion of discount (1,333) (1,360)

Operating (loss)/profit before working capital changes (234,046) 10,268

Changes in working capital:

Deposits and placements with banks and other financial institutions - -

Islamic financing 691,507 674,153

Other assets 2,813 5,387

Other liabilities (100,192) (1,114,985)

Deferred income (26) 1,174

Net claims paid for bank guarantee and takaful claims (3) (186)

Zakat paid - -

Net cash generated/(used in) from operating activities 360,053 (424,094)

Cash flow from investing activities

Purchase of investments (25,591) -

Proceed from disposal of investments 370,000 52,717

Cash flows from financing activities

Net repayment of financing payable (182,188) (250,612)

Proceeds from share capital - -

Net cash used in financing activities (182,188) (250,612)