Page 215 - EXIM-Bank_Annual-Report-2022

P. 215

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 213

Notes to the fiNaNcial statemeNts

45. INSURaNCE RISkS (cont’d.)

Claim liability sensitivity analysis (cont’d.)

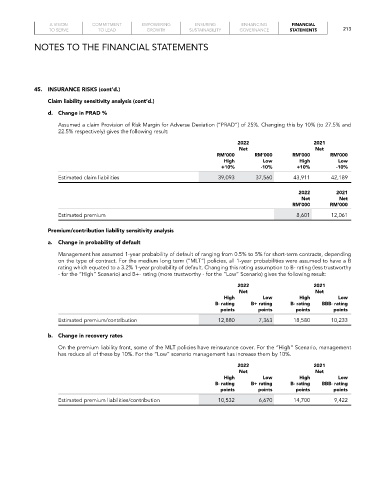

d. Change in PRaD %

Assumed a claim Provision of Risk Margin for Adverse Deviation (“PRAD”) of 25%. Changing this by 10% (to 27.5% and

22.5% respectively) gives the following result:

2022 2021

Net Net

rM’000 rM’000 rM’000 rM’000

high Low high Low

+10% -10% +10% -10%

Estimated claim liabilities 39,093 37,560 43,911 42,189

2022 2021

Net Net

rM’000 rM’000

Estimated premium 8,601 12,061

Premium/contribution liability sensitivity analysis

a. Change in probability of default

Management has assumed 1-year probability of default of ranging from 0.5% to 5% for short-term contracts, depending

on the type of contract. For the medium long term (“MLT”) policies, all 1-year probabilities were assumed to have a B

rating which equated to a 3.2% 1-year probability of default. Changing this rating assumption to B- rating (less trustworthy

- for the “High” Scenario) and B+- rating (more trustworthy - for the “Low” Scenario) gives the following result:

2022 2021

Net Net

high Low high Low

B- rating B+ rating B- rating BBB- rating

points points points points

Estimated premium/contribution 12,880 7,363 18,580 10,233

b. Change in recovery rates

On the premium liability front, some of the MLT policies have reinsurance cover. For the “High” Scenario, management

has reduce all of these by 10%. For the “Low” scenario management has increase them by 10%.

2022 2021

Net Net

high Low high Low

B- rating B+ rating B- rating BBB- rating

points points points points

Estimated premium liabilities/contribution 10,532 6,670 14,700 9,422