Page 243 - EXIM-Bank_Annual-Report-2022

P. 243

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 241

Notes to the fiNaNcial statemeNts

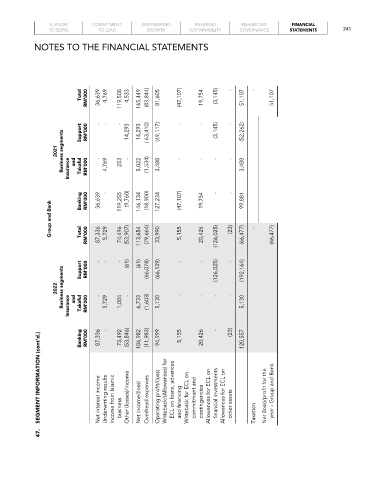

total rM’000 36,639 4,769 119,508 - 4,533 165,449 (83,844) 81,605 (47,107) - 19,754 (3,145) - 51,107 - 51,107

2021 Business segments Insurance and support takaful rM’000 rM’000 - - - 4,769 253 14,293 - 14,293 5,022 ( 63,410) (1,534) (49,117) 3,488 - - - (3,145) - - - (52,262) 3,488

Banking rM’000 36,639 - 119,255 (9,760) 146,134 (18,900) 127,234 (47,107) 19,754 - - 99,881

Group and Bank total rM’000 87,336 5,729 74,496 (53,907) 113,654 (79,664) 33,990 5,155 20,426 (126,025) (23) (66,477) - (66,477)

support rM’000 - - - (61) (61) (66,078) (66,139) - - (126,025) - (192,164)

Business segments

2022 Insurance and takaful rM’000 - 5,729 1,004 - 6,733 (1,603) 5,130 - - - - 5,130

Banking rM’000 87,336 - 73,492 (53,846) 106,982 (11,983) 94,999 5,155 20,426 - (23) 120,557

SEGMENT INFORMaTION (cont’d.) Net interest income Underwriting results Income from Islamic Other (losses)/income Net income/(loss) Overhead expenses Operating profit/(loss) Writeback/(Allowances) for ECL on loans, advances and financing Writeback for ECL on commitment and contingencies Allowances for ECL on financial investments Allowances for ECL on other assets Net (loss)/profit for the year - Group and Bank

47. business Taxation