Page 240 - EXIM-Bank_Annual-Report-2022

P. 240

238 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

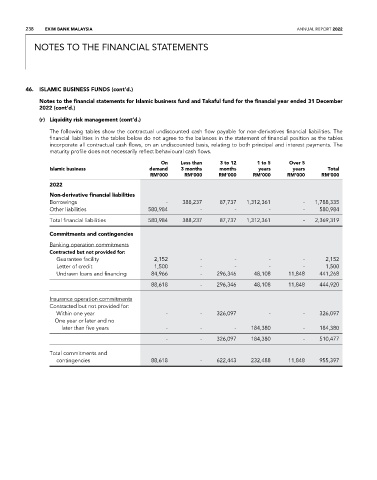

(r) Liquidity risk management (cont’d.)

The following tables show the contractual undiscounted cash flow payable for non-derivatives financial liabilities. The

financial liabilities in the tables below do not agree to the balances in the statement of financial position as the tables

incorporate all contractual cash flows, on an undiscounted basis, relating to both principal and interest payments. The

maturity profile does not necessarily reflect behavioural cash flows.

On Less than 3 to 12 1 to 5 Over 5

Islamic business demand 3 months months years years total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

2022

Non-derivative financial liabilities

Borrowings - 388,237 87,737 1,312,361 - 1,788,335

Other liabilities 580,984 - - - - 580,984

Total financial liabilities 580,984 388,237 87,737 1,312,361 - 2,369,319

Commitments and contingencies

Banking operation commitments

Contracted but not provided for:

Guarantee facility 2,152 - - - - 2,152

Letter of credit 1,500 - - - - 1,500

Undrawn loans and financing 84,966 - 296,346 48,108 11,848 441,268

88,618 - 296,346 48,108 11,848 444,920

Insurance operation commitments

Contracted but not provided for:

Within one year - - 326,097 - - 326,097

One year or later and no

later than five years - - - 184,380 - 184,380

- - 326,097 184,380 - 510,477

Total commitments and

contingencies 88,618 - 622,443 232,488 11,848 955,397