Page 235 - EXIM-Bank_Annual-Report-2022

P. 235

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 233

Notes to the fiNaNcial statemeNts

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

(m) Shariah disclosures (cont’d.)

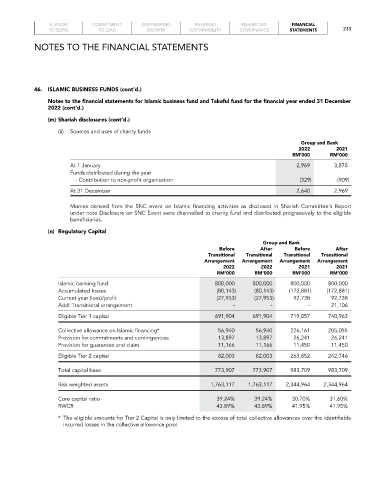

(ii) Sources and uses of charity funds

Group and Bank

2022 2021

rM’000 rM’000

At 1 January 2,969 3,878

Funds distributed during the year

- Contribution to non-profit organisation (329) (909)

At 31 December 2,640 2,969

Monies derived from the SNC event on Islamic financing activities as disclosed in Shariah Committee’s Report

under note Disclosure on SNC Event were channelled to charity fund and distributed progressively to the eligible

beneficiaries.

(n) Regulatory Capital

Group and Bank

Before After Before After

transitional transitional transitional transitional

Arrangement Arrangement Arrangement Arrangement

2022 2022 2021 2021

rM’000 rM’000 rM’000 rM’000

Islamic banking fund 800,000 800,000 800,000 800,000

Accumulated losses (80,143) (80,143) (172,881) (172,881)

Current year (loss)/profit (27,953) (27,953) 92,738 92,738

Add: Transitional arrangement - - - 21,106

Eligible Tier 1 capital 691,904 691,904 719,857 740,963

Collective allowance on Islamic financing* 56,940 56,940 226,161 205,055

Provision for commitments and contingencies 13,897 13,897 26,241 26,241

Provision for guarantee and claim 11,166 11,166 11,450 11,450

Eligible Tier 2 capital 82,003 82,003 263,852 242,746

Total capital base 773,907 773,907 983,709 983,709

Risk weighted assets 1,763,117 1,763,117 2,344,964 2,344,964

Core capital ratio 39.24% 39.24% 30.70% 31.60%

RWCR 43.89% 43.89% 41.95% 41.95%

* The eligible amounts for Tier 2 Capital is only limited to the excess of total collective allowances over the identifiable

incurred losses in the collective allowance pool.