Page 231 - EXIM-Bank_Annual-Report-2022

P. 231

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 229

Notes to the fiNaNcial statemeNts

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

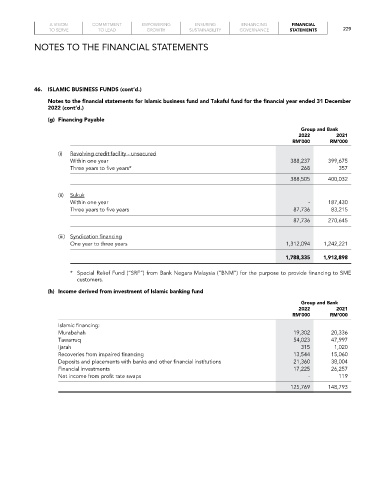

(g) Financing Payable

Group and Bank

2022 2021

rM’000 rM’000

(i) Revolving credit facility - unsecured

Within one year 388,237 399,675

Three years to five years* 268 357

388,505 400,032

(ii) Sukuk

Within one year - 187,430

Three years to five years 87,736 83,215

87,736 270,645

(iii) Syndication financing

One year to three years 1,312,094 1,242,221

1,788,335 1,912,898

* Special Relief Fund (“SRF”) from Bank Negara Malaysia (“BNM”) for the purpose to provide financing to SME

customers.

(h) Income derived from investment of Islamic banking fund

Group and Bank

2022 2021

rM’000 rM’000

Islamic financing:

Murabahah 19,302 20,336

Tawarruq 54,023 47,997

Ijarah 315 1,020

Recoveries from impaired financing 13,544 15,060

Deposits and placements with banks and other financial institutions 21,360 38,004

Financial investments 17,225 26,257

Net income from profit rate swaps - 119

125,769 148,793