Page 232 - EXIM-Bank_Annual-Report-2022

P. 232

230 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

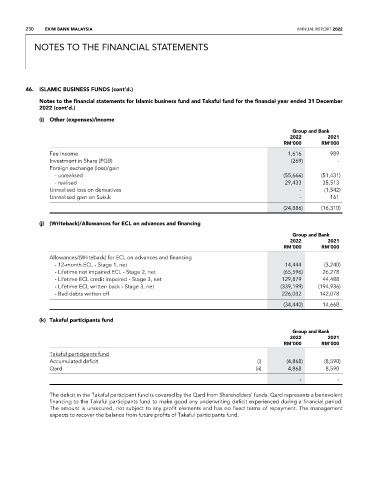

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

(i) Other (expenses)/income

Group and Bank

2022 2021

rM’000 rM’000

Fee Income 1,616 989

Investment in Share (PGB) (269) -

Foreign exchange (loss)/gain

- unrealised (55,666) (51,431)

- realised 29,433 35,513

Unrealised loss on derivatives - (1,542)

Unrealised gain on Sukuk - 161

(24,886) (16,310)

(j) (Writeback)/allowances for ECL on advances and financing

Group and Bank

2022 2021

rM’000 rM’000

Allowances/(Writeback) for ECL on advances and financing

- 12-month ECL - Stage 1, net 14,444 (3,240)

- Lifetime not impaired ECL - Stage 2, net (65,596) 26,278

- Lifetime ECL credit impaired - Stage 3, net 129,879 44,488

- Lifetime ECL written back - Stage 3, net (339,199) (194,936)

- Bad debts written off 226,032 142,078

(34,440) 14,668

(k) Takaful participants fund

Group and Bank

2022 2021

rM’000 rM’000

Takaful participants fund

Accumulated deficit (i) (4,868) (8,590)

qard (ii) 4,868 8,590

- -

The deficit in the Takaful participant fund is covered by the qard from Shareholders’ funds. qard represents a benevolent

financing to the Takaful participants fund to make good any underwriting deficit experienced during a financial period.

The amount is unsecured, not subject to any profit elements and has no fixed terms of repayment. The management

expects to recover the balance from future profits of Takaful participants fund.