Page 239 - EXIM-Bank_Annual-Report-2022

P. 239

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 237

Notes to the fiNaNcial statemeNts

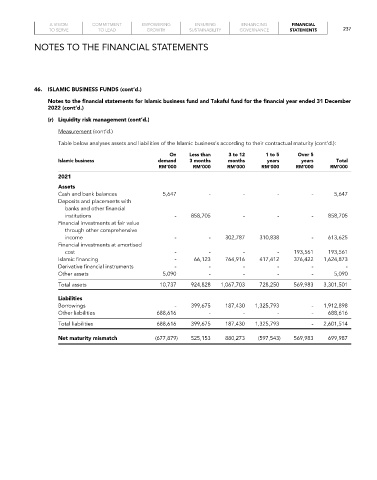

46. ISLaMIC BUSINESS FUNDS (cont’d.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2022 (cont’d.)

(r) Liquidity risk management (cont’d.)

Measurement (cont’d.)

Table below analyses assets and liabilities of the Islamic business’s according to their contractual maturity (cont’d.):

On Less than 3 to 12 1 to 5 Over 5

Islamic business demand 3 months months years years total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

2021

Assets

Cash and bank balances 5,647 - - - - 5,647

Deposits and placements with

banks and other financial

institutions - 858,705 - - - 858,705

Financial investments at fair value

through other comprehensive

income - - 302,787 310,838 - 613,625

Financial investments at amortised

cost - - - - 193,561 193,561

Islamic financing - 66,123 764,916 417,412 376,422 1,624,873

Derivative financial instruments - - - - - -

Other assets 5,090 - - - - 5,090

Total assets 10,737 924,828 1,067,703 728,250 569,983 3,301,501

Liabilities

Borrowings - 399,675 187,430 1,325,793 - 1,912,898

Other liabilities 688,616 - - - - 688,616

Total liabilities 688,616 399,675 187,430 1,325,793 - 2,601,514

Net maturity mismatch (677,879) 525,153 880,273 (597,543) 569,983 699,987