Page 113 - EXIM-Bank_Annual-Report-2023

P. 113

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 111

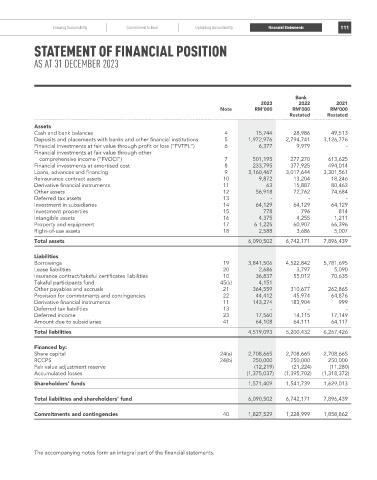

STaTEmEnT Of fInanCIal POSITIOn

as at 31 december 2023

Bank

2023 2022 2021

Note rM’000 rM’000 rM’000

restated restated

Assets

Cash and bank balances 4 15,744 28,986 49,513

Deposits and placements with banks and other financial institutions 5 1,972,976 2,794,741 3,126,776

Financial investments at fair value through profit or loss (“FVTPL”) 6 6,377 9,979 -

Financial investments at fair value through other

comprehensive income (“FVOCI”) 7 501,195 277,270 613,625

Financial investments at amortised cost 8 233,795 377,925 494,014

Loans, advances and financing 9 3,160,467 3,017,644 3,301,561

Reinsurance contract assets 10 9,872 13,204 18,246

Derivative financial instruments 11 63 15,887 80,463

Other assets 12 56,918 72,762 74,684

Deferred tax assets 13 - - -

Investment in subsidiaries 14 64,129 64,129 64,129

Investment properties 15 778 796 814

Intangible assets 16 4,375 4,255 1,211

Property and equipment 17 6 1,225 60,907 66,396

Right-of-use assets 18 2,588 3,686 5,007

Total assets 6,090,502 6,742,171 7,896,439

Liabilities

Borrowings 19 3,841,506 4,522,842 5,781,695

Lease liabilities 20 2,686 3,797 5,090

Insurance contract/takaful certificates liabilities 10 36,837 55,012 70,635

Takaful participants fund 45(k) 4,151 - -

Other payables and accruals 21 364,559 310,677 262,865

Provision for commitments and contingencies 22 44,412 45,974 64,876

Derivative financial instruments 11 143,274 183,904 999

Deferred tax liabilities 13 - - -

Deferred income 23 17,560 14,115 17,149

Amount due to subsidiaries 41 64,108 64,111 64,117

Total liabilities 4,519,093 5,200,432 6,267,426

Financed by:

Share capital 24(a) 2,708,665 2,708,665 2,708,665

RCCPS 24(b) 250,000 250,000 250,000

Fair value adjustment reserve (12,219) (21,224) (11,280)

Accumulated losses (1,375,037) (1,395,702) (1,318,372)

Shareholders’ funds 1,571,409 1,541,739 1,629,013

Total liabilities and shareholders’ fund 6,090,502 6,742,171 7,896,439

Commitments and contingencies 40 1,827,529 1,228,999 1,858,862

The accompanying notes form an integral part of the financial statements.