Page 114 - EXIM-Bank_Annual-Report-2023

P. 114

EXIM BANK MALAYSIA

112 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

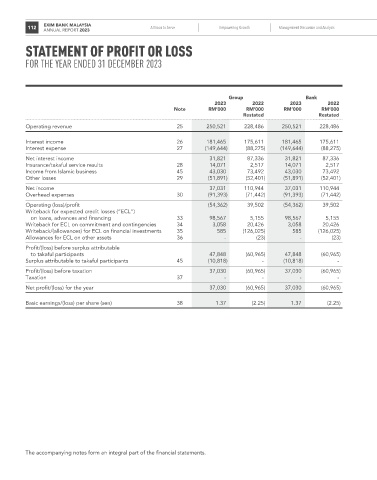

STaTEmEnT Of PROfIT OR lOSS

for the year ended 31 december 2023

Group Bank

2023 2022 2023 2022

Note rM’000 rM’000 rM’000 rM’000

restated restated

Operating revenue 25 250,521 228,486 250,521 228,486

Interest income 26 181,465 175,611 181,465 175,611

Interest expense 27 (149,644) (88,275) (149,644) (88,275)

Net interest income 31,821 87,336 31,821 87,336

Insurance/takaful service results 28 14,071 2,517 14,071 2,517

Income from Islamic business 45 43,030 73,492 43,030 73,492

Other losses 29 (51,891) (52,401) (51,891) (52,401)

Net income 37,031 110,944 37,031 110,944

Overhead expenses 30 (91,393) (71,442) (91,393) (71,442)

Operating (loss)/profit (54,362) 39,502 (54,362) 39,502

Writeback for expected credit losses (“ECL”)

on loans, advances and financing 33 98,567 5,155 98,567 5,155

Writeback for ECL on commitment and contingencies 34 3,058 20,426 3,058 20,426

Writeback/(allowances) for ECL on financial investments 35 585 (126,025) 585 (126,025)

Allowances for ECL on other assets 36 - (23) - (23)

Profit/(loss) before surplus attributable

to takaful participants 47,848 (60,965) 47,848 (60,965)

Surplus attributable to takaful participants 45 (10,818) - (10,818) -

Profit/(loss) before taxation 37,030 (60,965) 37,030 (60,965)

Taxation 37 - - - -

Net profit/(loss) for the year 37,030 (60,965) 37,030 (60,965)

Basic earnings/(loss) per share (sen) 38 1.37 (2.25) 1.37 (2.25)

The accompanying notes form an integral part of the financial statements.