Page 187 - EXIM-Bank_Annual-Report-2023

P. 187

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 185

Notes to the fiNaNcial statemeNts

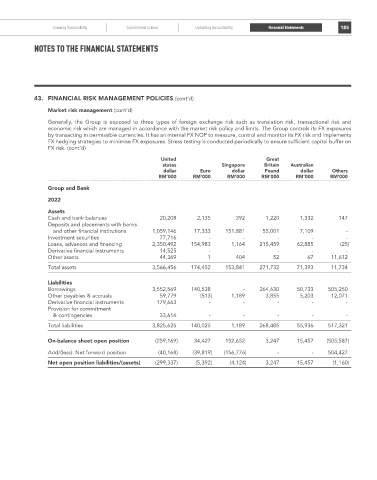

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Market risk management (cont’d)

Generally, the Group is exposed to three types of foreign exchange risk such as translation risk, transactional risk and

economic risk which are managed in accordance with the market risk policy and limits. The Group controls its FX exposures

by transacting in permissible currencies. It has an internal FX NOP to measure, control and monitor its FX risk and implements

FX hedging strategies to minimise FX exposures. Stress testing is conducted periodically to ensure sufficient capital buffer on

FX risk. (cont’d)

united Great

states Singapore Britain Australian

dollar Euro dollar Pound dollar Others

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Group and Bank

2022

Assets

Cash and bank balances 20,208 2,135 392 1,220 1,332 147

Deposits and placements with banks

and other financial institutions 1,059,146 17,333 151,881 55,001 7,109 -

Investment securities 77,716 - - - - -

Loans, advances and financing 2,350,492 154,983 1,164 215,459 62,885 (25)

Derivative financial instruments 14,525 - - - - -

Other assets 44,369 1 404 52 67 11,612

Total assets 3,566,456 174,452 153,841 271,732 71,393 11,734

Liabilities

Borrowings 3,552,569 140,538 - 264,630 50,733 505,250

Other payables & accruals 59,779 (513) 1,189 3,855 5,203 12,071

Derivative financial instruments 179,663 - - - - -

Provision for commitment

& contingencies 33,614 - - - - -

Total liabilities 3,825,625 140,025 1,189 268,485 55,936 517,321

On-balance sheet open position (259,169) 34,427 152,652 3,247 15,457 (505,587)

Add/(less): Net forward position (40,168) (39,819) (156,776) - - 504,427

Net open position liabilities/(assets) (299,337) (5,392) (4,124) 3,247 15,457 (1,160)