Page 191 - EXIM-Bank_Annual-Report-2023

P. 191

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 189

Notes to the fiNaNcial statemeNts

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Asset liability management (cont’d)

Measurement (cont’d)

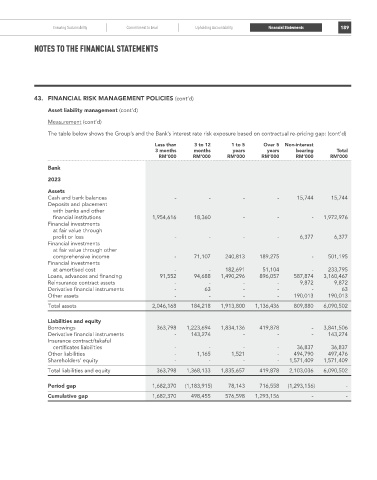

The table below shows the Group’s and the Bank’s interest rate risk exposure based on contractual re-pricing gap: (cont’d)

Less than 3 to 12 1 to 5 over 5 Non-interest

3 months months years years bearing Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Bank

2023

Assets

Cash and bank balances - - - - 15,744 15,744

Deposits and placement

with banks and other

financial institutions 1,954,616 18,360 - - - 1,972,976

Financial investments

at fair value through

profit or loss - - - - 6,377 6,377

Financial investments

at fair value through other

comprehensive income - 71,107 240,813 189,275 - 501,195

Financial investments

at amortised cost - - 182,691 51,104 - 233,795

Loans, advances and financing 91,552 94,688 1,490,296 896,057 587,874 3,160,467

Reinsurance contract assets - - - - 9,872 9,872

Derivative financial instruments - 63 - - - 63

Other assets - - - - 190,013 190,013

Total assets 2,046,168 184,218 1,913,800 1,136,436 809,880 6,090,502

Liabilities and equity

Borrowings 363,798 1,223,694 1,834,136 419,878 - 3,841,506

Derivative financial instruments - 143,274 - - - 143,274

Insurance contract/takaful

certificates liabilities - - - - 36,837 36,837

Other liabilities - 1,165 1,521 - 494,790 497,476

Shareholders’ equity - - - - 1,571,409 1,571,409

Total liabilities and equity 363,798 1,368,133 1,835,657 419,878 2,103,036 6,090,502

Period gap 1,682,370 (1,183,915) 78,143 716,558 (1,293,156) -

Cumulative gap 1,682,370 498,455 576,598 1,293,156 - -