Page 190 - EXIM-Bank_Annual-Report-2023

P. 190

EXIM BANk MALAySIA

188 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

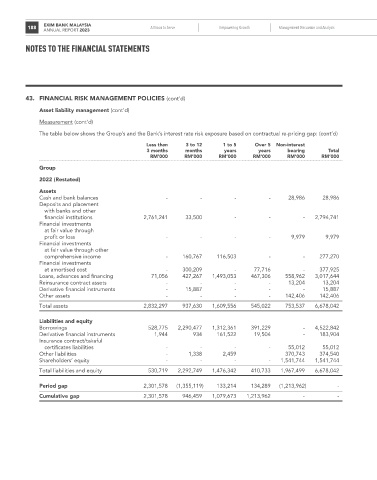

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Asset liability management (cont’d)

Measurement (cont’d)

The table below shows the Group’s and the Bank’s interest rate risk exposure based on contractual re-pricing gap: (cont’d)

Less than 3 to 12 1 to 5 over 5 Non-interest

3 months months years years bearing Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Group

2022 (Restated)

Assets

Cash and bank balances - - - - 28,986 28,986

Deposits and placement

with banks and other

financial institutions 2,761,241 33,500 - - - 2,794,741

Financial investments

at fair value through

profit or loss - - - - 9,979 9,979

Financial investments

at fair value through other

comprehensive income - 160,767 116,503 - - 277,270

Financial investments

at amortised cost - 300,209 - 77,716 - 377,925

Loans, advances and financing 71,056 427,267 1,493,053 467,306 558,962 3,017,644

Reinsurance contract assets - - - - 13,204 13,204

Derivative financial instruments - 15,887 - - - 15,887

Other assets - - - - 142,406 142,406

Total assets 2,832,297 937,630 1,609,556 545,022 753,537 6,678,042

Liabilities and equity

Borrowings 528,775 2,290,477 1,312,361 391,229 - 4,522,842

Derivative financial instruments 1,944 934 161,522 19,504 - 183,904

Insurance contract/takaful

certificates liabilities - - - - 55,012 55,012

Other liabilities - 1,338 2,459 370,743 374,540

Shareholders’ equity - - - - 1,541,744 1,541,744

Total liabilities and equity 530,719 2,292,749 1,476,342 410,733 1,967,499 6,678,042

Period gap 2,301,578 (1,355,119) 133,214 134,289 (1,213,962) -

Cumulative gap 2,301,578 946,459 1,079,673 1,213,962 - -