Page 195 - EXIM-Bank_Annual-Report-2023

P. 195

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 193

Notes to the fiNaNcial statemeNts

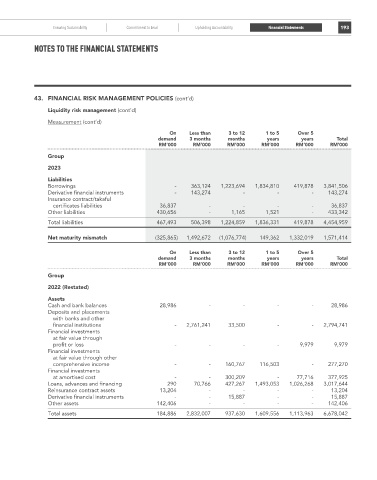

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Liquidity risk management (cont’d)

Measurement (cont’d)

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Group

2023

Liabilities

Borrowings - 363,124 1,223,694 1,834,810 419,878 3,841,506

Derivative financial instruments - 143,274 - - - 143,274

Insurance contract/takaful

certificates liabilities 36,837 - - - - 36,837

Other liabilities 430,656 - 1,165 1,521 - 433,342

Total liabilities 467,493 506,398 1,224,859 1,836,331 419,878 4,454,959

Net maturity mismatch (325,865) 1,492,672 (1,076,774) 149,362 1,332,019 1,571,414

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Group

2022 (Restated)

Assets

Cash and bank balances 28,986 - - - - 28,986

Deposits and placements

with banks and other

financial institutions - 2,761,241 33,500 - - 2,794,741

Financial investments

at fair value through

profit or loss - - - - 9,979 9,979

Financial investments

at fair value through other

comprehensive income - - 160,767 116,503 - 277,270

Financial investments

at amortised cost - - 300,209 - 77,716 377,925

Loans, advances and financing 290 70,766 427,267 1,493,053 1,026,268 3,017,644

Reinsurance contract assets 13,204 - - - - 13,204

Derivative financial instruments - - 15,887 - - 15,887

Other assets 142,406 - - - - 142,406

Total assets 184,886 2,832,007 937,630 1,609,556 1,113,963 6,678,042