Page 198 - EXIM-Bank_Annual-Report-2023

P. 198

EXIM BANk MALAySIA

196 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

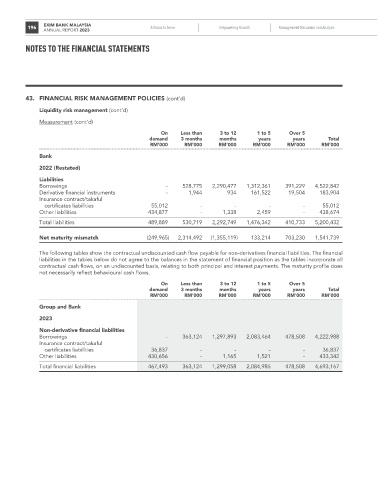

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Liquidity risk management (cont’d)

Measurement (cont’d)

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Bank

2022 (Restated)

Liabilities

Borrowings - 528,775 2,290,477 1,312,361 391,229 4,522,842

Derivative financial instruments - 1,944 934 161,522 19,504 183,904

Insurance contract/takaful

certificates liabilities 55,012 - - - - 55,012

Other liabilities 434,877 - 1,338 2,459 - 438,674

Total liabilities 489,889 530,719 2,292,749 1,476,342 410,733 5,200,432

Net maturity mismatch (249,965) 2,314,492 (1,355,119) 133,214 703,230 1,541,739

The following tables show the contractual undiscounted cash flow payable for non-derivatives financial liabilities. The financial

liabilities in the tables below do not agree to the balances in the statement of financial position as the tables incorporate all

contractual cash flows, on an undiscounted basis, relating to both principal and interest payments. The maturity profile does

not necessarily reflect behavioural cash flows.

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Group and Bank

2023

Non-derivative financial liabilities

Borrowings - 363,124 1,297,893 2,083,464 478,508 4,222,988

Insurance contract/takaful

certificates liabilities 36,837 - - - - 36,837

Other liabilities 430,656 - 1,165 1,521 - 433,342

Total financial liabilities 467,493 363,124 1,299,058 2,084,985 478,508 4,693,167