Page 203 - EXIM-Bank_Annual-Report-2023

P. 203

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 201

Notes to the fiNaNcial statemeNts

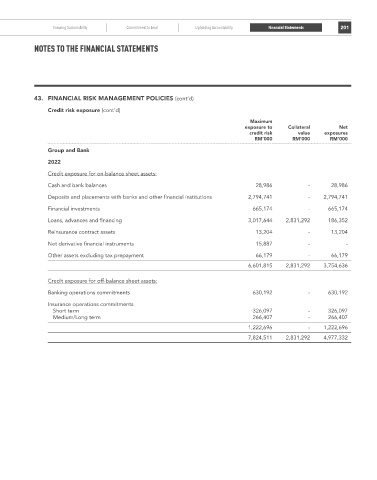

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Credit risk exposure (cont’d)

Maximum

exposure to Collateral Net

credit risk value exposures

rM’000 rM’000 rM’000

Group and Bank

2022

Credit exposure for on-balance sheet assets:

Cash and bank balances 28,986 - 28,986

Deposits and placements with banks and other financial institutions 2,794,741 - 2,794,741

Financial investments 665,174 - 665,174

Loans, advances and financing 3,017,644 2,831,292 186,352

Reinsurance contract assets 13,204 - 13,204

Net derivative financial instruments 15,887 - -

Other assets excluding tax prepayment 66,179 - 66,179

6,601,815 2,831,292 3,754,636

Credit exposure for off-balance sheet assets:

Banking operations commitments 630,192 - 630,192

Insurance operations commitments

Short term 326,097 - 326,097

Medium/Long term 266,407 - 266,407

1,222,696 - 1,222,696

7,824,511 2,831,292 4,977,332