Page 208 - EXIM-Bank_Annual-Report-2023

P. 208

EXIM BANk MALAySIA

206 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

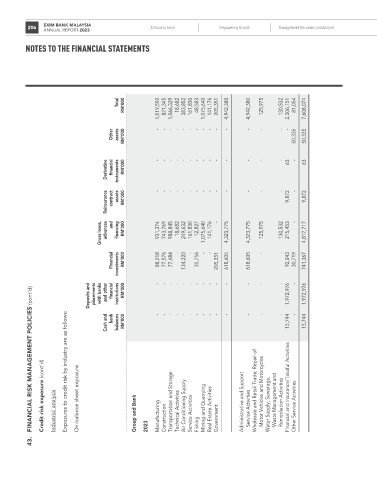

Total rM’000 1,019,592 821,345 1,066,329 18,682 383,852 161,830 48,583 1,075,640 141,176 205,351 4,942,380 4,942,380 125,975 130,532 2,306,151 81,054 7,608,074

Other assets rM’000 - - - - - - - - - - - - - - - 50,335 50,335

Derivative financial instruments rM’000 - - - - - - - - - - - - - - 63 - 63

reinsurance contract assets rM’000 - - - - - - - - - - - - - - 9,872 - 9,872

Gross loans, advances and financing rM’000 931,374 743,769 988,845 18,682 249,632 161,830 12,827 1,075,640 141,176 - 4,323,775 4,323,775 125,975 130,532 215,453 - 4,817,717

- - - - - -

Financial investments rM’000 88,218 77,576 77,484 134,220 35,756 205,351 618,605 618,605 92,043 30,719 741,367

Deposits and placements with banks and other financial institutions rM’000 - - - - - - - - - - - - - - 1,972,976 - 1,972,976

FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Cash and balances rM’000 15,744 15,744

bank - - - - - - - - - - - - - - -

Credit risk exposure (cont’d) Industrial analysis Exposures to credit risk by industry are as follows: On-balance sheet exposure Group and Bank Manufacturing Construction Transportation and Storage Technical Activities Air Conditioning Supply Service Activities Mining and Quarrying Real Estate Activities Government Administrative and Support Service Activities Wholesale and Retail Trade; Repair of Motor Vehicles and Motorcycles Water Supply; Sewerage

43. 2023 Fishing