Page 211 - EXIM-Bank_Annual-Report-2023

P. 211

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 209

Notes to the fiNaNcial statemeNts

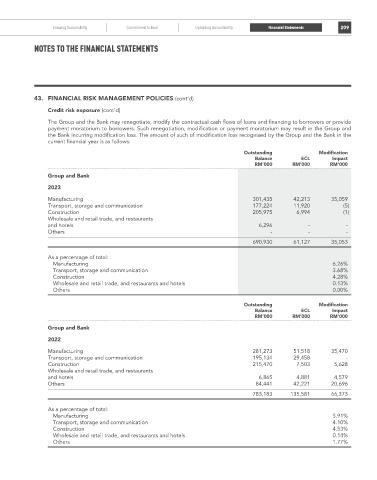

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Credit risk exposure (cont’d)

The Group and the Bank may renegotiate, modify the contractual cash flows of loans and financing to borrowers or provide

payment moratorium to borrowers. Such renegotiation, modification or payment moratorium may result in the Group and

the Bank incurring modification loss. The amount of such of modification loss recognised by the Group and the Bank in the

current financial year is as follows:

Outstanding Modification

Balance ECL Impact

rM’000 rM’000 rM’000

Group and Bank

2023

Manufacturing 301,435 42,213 35,059

Transport, storage and communication 177,224 11,920 (5)

Construction 205,975 6,994 (1)

Wholesale and retail trade, and restaurants

and hotels 6,296 - -

Others - - -

690,930 61,127 35,053

As a percentage of total:

Manufacturing 6.26%

Transport, storage and communication 3.68%

Construction 4.28%

Wholesale and retail trade, and restaurants and hotels 0.13%

Others 0.00%

Outstanding Modification

Balance ECL Impact

rM’000 rM’000 rM’000

Group and Bank

2022

Manufacturing 281,273 51,518 35,470

Transport, storage and communication 195,134 29,458 -

Construction 215,470 7,503 5,628

Wholesale and retail trade, and restaurants

and hotels 6,865 4,881 4,579

Others 84,441 42,221 20,696

783,183 135,581 66,373

As a percentage of total:

Manufacturing 5.91%

Transport, storage and communication 4.10%

Construction 4.53%

Wholesale and retail trade, and restaurants and hotels 0.14%

Others 1.77%