Page 215 - EXIM-Bank_Annual-Report-2023

P. 215

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 213

Notes to the fiNaNcial statemeNts

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Fair values

(i) Fair value hierarchy

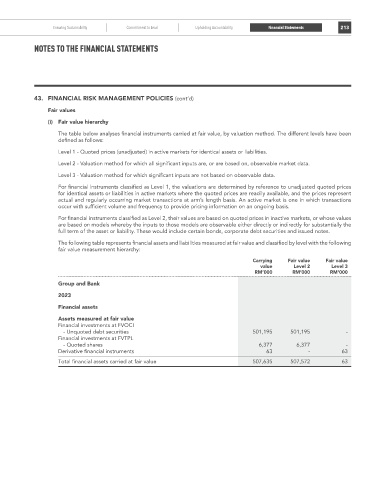

The table below analyses financial instruments carried at fair value, by valuation method. The different levels have been

defined as follows:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 - Valuation method for which all significant inputs are, or are based on, observable market data.

Level 3 - Valuation method for which significant inputs are not based on observable data.

For financial instruments classified as Level 1, the valuations are determined by reference to unadjusted quoted prices

for identical assets or liabilities in active markets where the quoted prices are readily available, and the prices represent

actual and regularly occurring market transactions at arm’s length basis. An active market is one in which transactions

occur with sufficient volume and frequency to provide pricing information on an ongoing basis.

For financial instruments classified as Level 2, their values are based on quoted prices in inactive markets, or whose values

are based on models whereby the inputs to those models are observable either directly or indirectly for substantially the

full term of the asset or liability. These would include certain bonds, corporate debt securities and issued notes.

The following table represents financial assets and liabilities measured at fair value and classified by level with the following

fair value measurement hierarchy:

Carrying Fair value Fair value

value Level 2 Level 3

rM’000 rM’000 rM’000

Group and Bank

2023

Financial assets

Assets measured at fair value

Financial investments at FVOCI

- Unquoted debt securities 501,195 501,195 -

Financial investments at FVTPL

- Quoted shares 6,377 6,377 -

Derivative financial instruments 63 - 63

Total financial assets carried at fair value 507,635 507,572 63