Page 220 - EXIM-Bank_Annual-Report-2023

P. 220

EXIM BANk MALAySIA

218 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

44. INSurANCE rISkS (cont’d)

Claim liability sensitivity analysis (cont’d)

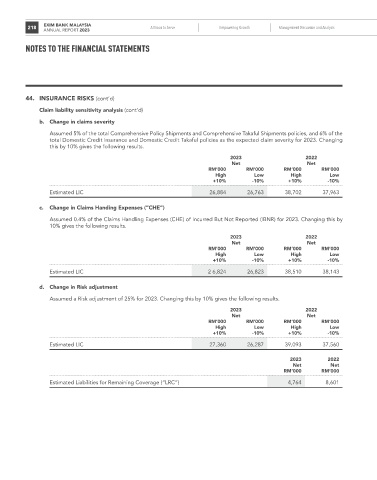

b. Change in claims severity

Assumed 5% of the total Comprehensive Policy Shipments and Comprehensive Takaful Shipments policies, and 6% of the

total Domestic Credit Insurance and Domestic Credit Takaful policies as the expected claim severity for 2023. Changing

this by 10% gives the following results.

2023 2022

Net Net

rM’000 rM’000 rM’000 rM’000

high Low high Low

+10% -10% +10% -10%

Estimated LIC 26,884 26,763 38,702 37,963

c. Change in Claims Handing Expenses (“CHE”)

Assumed 0.4% of the Claims Handling Expenses (CHE) of Incurred But Not Reported (IBNR) for 2023. Changing this by

10% gives the following results.

2023 2022

Net Net

rM’000 rM’000 rM’000 rM’000

high Low high Low

+10% -10% +10% -10%

Estimated LIC 2 6,824 26,823 38,510 38,143

d. Change in Risk adjustment

Assumed a Risk adjustment of 25% for 2023. Changing this by 10% gives the following results.

2023 2022

Net Net

rM’000 rM’000 rM’000 rM’000

high Low high Low

+10% -10% +10% -10%

Estimated LIC 27,360 26,287 39,093 37,560

2023 2022

Net Net

rM’000 rM’000

Estimated Liabilities for Remaining Coverage (“LRC”) 4,764 8,601