Page 223 - EXIM-Bank_Annual-Report-2023

P. 223

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 221

Notes to the fiNaNcial statemeNts

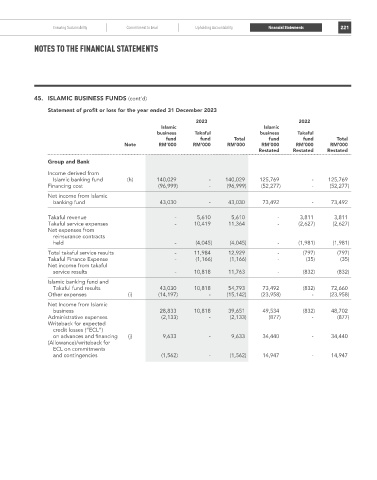

45. ISLAMIC BuSINESS FuNDS (cont’d)

Statement of profit or loss for the year ended 31 December 2023

2023 2022

Islamic Islamic

business Takaful business Takaful

fund fund Total fund fund Total

Note rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

restated restated restated

Group and Bank

Income derived from

Islamic banking fund (h) 140,029 - 140,029 125,769 - 125,769

Financing cost (96,999) - (96,999) (52,277) - (52,277)

Net income from Islamic

banking fund 43,030 - 43,030 73,492 - 73,492

Takaful revenue - 5,610 5,610 - 3,811 3,811

Takaful service expenses - 10,419 11,364 - (2,627) (2,627)

Net expenses from

reinsurance contracts

held - (4,045) (4,045) - (1,981) (1,981)

Total takaful service results - 11,984 12,929 - (797) (797)

Takaful Finance Expense - (1,166) (1,166) - (35) (35)

Net income from takaful

service results - 10,818 11,763 - (832) (832)

Islamic banking fund and

Takaful fund results 43,030 10,818 54,793 73,492 (832) 72,660

Other expenses (i) (14,197) - (15,142) (23,958) - (23,958)

Net Income from Islamic

business 28,833 10,818 39,651 49,534 (832) 48,702

Administrative expenses (2,133) - (2,133) (877) - (877)

Writeback for expected

credit losses (“ECL”)

on advances and financing (j) 9,633 - 9,633 34,440 - 34,440

(Allowance)/writeback for

ECL on commitments

and contingencies (1,562) - (1,562) 14,947 - 14,947