Page 226 - EXIM-Bank_Annual-Report-2023

P. 226

EXIM BANk MALAySIA

224 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

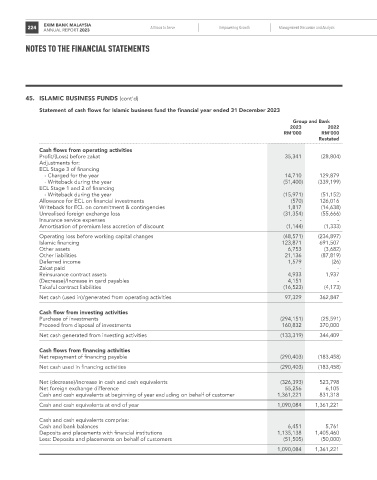

45. ISLAMIC BuSINESS FuNDS (cont’d)

Statement of cash flows for Islamic business fund the financial year ended 31 December 2023

Group and Bank

2023 2022

rM’000 rM’000

restated

Cash flows from operating activities

Profit/(Loss) before zakat 35,341 (28,804)

Adjustments for:

ECL Stage 3 of financing

- Charged for the year 14,710 129,879

- Writeback during the year (51,400) (339,199)

ECL Stage 1 and 2 of financing

- Writeback during the year (15,971) (51,152)

Allowance for ECL on financial investments (570) 126,016

Writeback for ECL on commitment & contingencies 1,817 (14,638)

Unrealised foreign exchange loss (31,354) (55,666)

Insurance service expenses - -

Amortisation of premium less accretion of discount (1,144) (1,333)

Operating loss before working capital changes (48,571) (234,897)

Islamic financing 123,871 691,507

Other assets 6,753 (3,682)

Other liabilities 21,136 (87,819)

Deferred income 1,579 (26)

Zakat paid - -

Reinsurance contract assets 4,933 1,937

(Decrease)/Increase in qard payables 4,151 -

Takaful contract liabilities (16,523) (4,173)

Net cash (used in)/generated from operating activities 97,329 362,847

Cash flow from investing activities

Purchase of investments (294,151) (25,591)

Proceed from disposal of investments 160,832 370,000

Net cash generated from investing activities (133,319) 344,409

Cash flows from financing activities

Net repayment of financing payable (290,403) (183,458)

Net cash used in financing activities (290,403) (183,458)

Net (decrease)/increase in cash and cash equivalents (326,393) 523,798

Net foreign exchange difference 55,256 6,105

Cash and cash equivalents at beginning of year excluding on behalf of customer 1,361,221 831,318

Cash and cash equivalents at end of year 1,090,084 1,361,221

Cash and cash equivalents comprise:

Cash and bank balances 6,451 5,761

Deposits and placements with financial institutions 1,135,138 1,405,460

Less: Deposits and placements on behalf of customers (51,505) (50,000)

1,090,084 1,361,221