Page 231 - EXIM-Bank_Annual-Report-2023

P. 231

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 229

Notes to the fiNaNcial statemeNts

45. ISLAMIC BuSINESS FuNDS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2023

(cont’d)

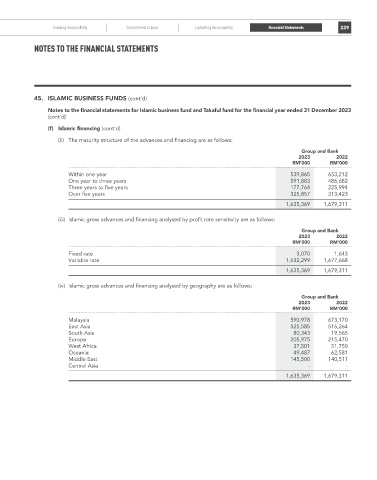

(f) Islamic financing (cont’d)

(ii) The maturity structure of the advances and financing are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Within one year 539,865 653,212

One year to three years 591,883 486,682

Three years to five years 177,764 225,994

Over five years 325,857 313,423

1,635,369 1,679,311

(iii) Islamic gross advances and financing analysed by profit rate sensitivity are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Fixed rate 3,070 1,643

Variable rate 1,632,299 1,677,668

1,635,369 1,679,311

(iv) Islamic gross advances and financing analysed by geography are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Malaysia 590,978 673,170

East Asia 525,585 516,264

South Asia 80,343 19,565

Europe 205,975 215,470

West Africa 37,501 51,750

Oceania 49,487 62,581

Middle East 145,500 140,511

Central Asia - -

1,635,369 1,679,311