Page 229 - EXIM-Bank_Annual-Report-2023

P. 229

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 227

Notes to the fiNaNcial statemeNts

45. ISLAMIC BuSINESS FuNDS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2023

(cont’d)

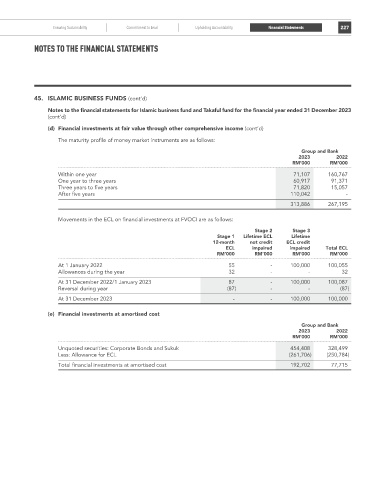

(d) Financial investments at fair value through other comprehensive income (cont’d)

The maturity profile of money market instruments are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Within one year 71,107 160,767

One year to three years 60,917 91,371

Three years to five years 71,820 15,057

After five years 110,042 -

313,886 267,195

Movements in the ECL on financial investments at FVOCI are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

rM’000 rM’000 rM’000 rM’000

At 1 January 2022 55 - 100,000 100,055

Allowances during the year 32 - - 32

At 31 December 2022/1 January 2023 87 - 100,000 100,087

Reversal during year (87) - - (87)

At 31 December 2023 - - 100,000 100,000

(e) Financial investments at amortised cost

Group and Bank

2023 2022

rM’000 rM’000

Unquoted securities: Corporate Bonds and Sukuk 454,408 328,499

Less: Allowance for ECL (261,706) (250,784)

Total financial investments at amortised cost 192,702 77,715